Following my deep dive on ASOS, I got some comments saying that I spent so much time on the business story and not enough on the financial metrics.

You have complied a very good qualitative analysis of Asos. However, economic aspect of the biz is as imp. They generate poor return on capital, so in case of inflation and supply chain issues they can just go negative, that growth with low returns on capital is not that good TBH

— Manish (@MindofManish) April 13, 2022

The financial metrics all got massive hits since the end of 2018 due to bad investments and the foundation of the new US Atlanta warehouse, followed by supply-chain issues and incoming inflation.

These events are soon to be behind the company, potentially seeing the financial performance going back to the numbers before 2018.

My mental model around ASOS is that of Chipotle after the food poisoning. If you focused on metrics - that was a catastrophe. But if you focused on the business, you could see that the current metrics are not representative of the future.

Yet, let us take a look at some financial measures compared to the broad industry.

Operating Margins

Let's start with the margins' bottom line: the operating margins.

To understand these business margins, I like to watch multiple competitors and their margins through the years. This is a violin chart of operating margins for some fashion retailers.

Two points that don't pass through this chart:

- The latest results from ASOS are the absolute bottom here, with -0.2% last quarter.

- Historically, ASOS had better margins, averaging around 4%-5%. The 2016-2022 average is 3%, with most recent average going even lower.

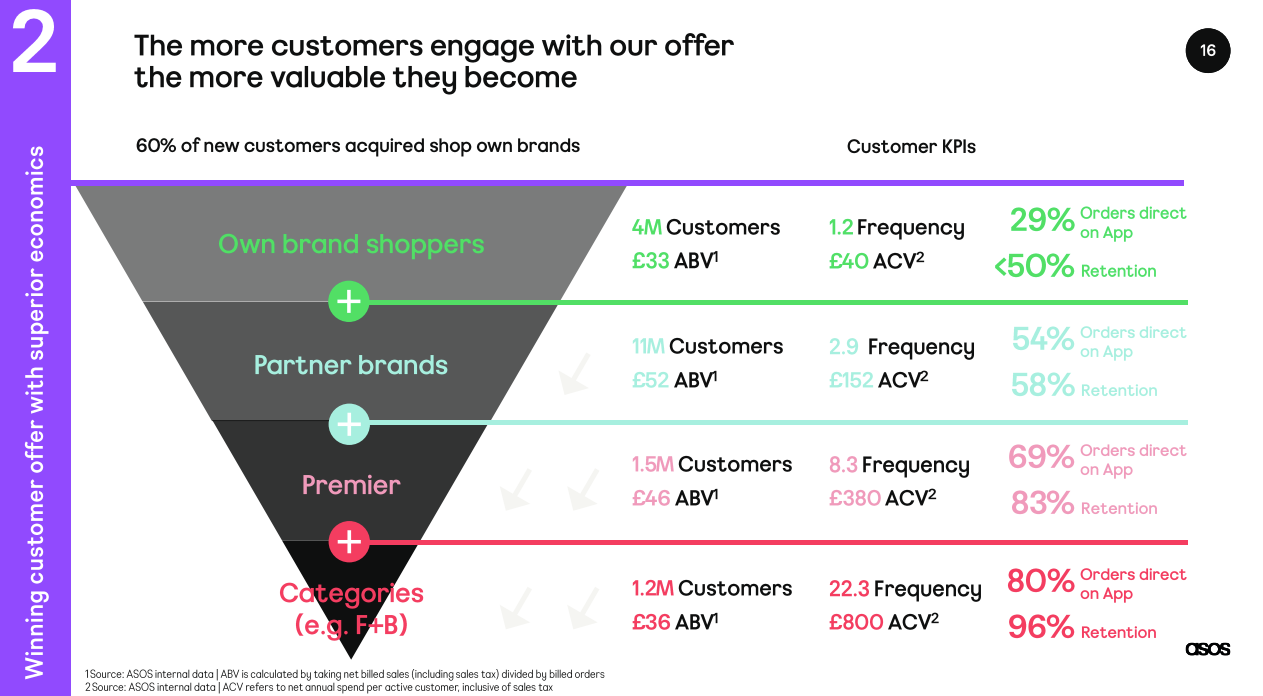

First vs. Third party products

Selling your own products as a retailer yields higher margins than selling some third-party brand that keeps most of the profits.

Let's focus on three companies: ASOS, Boohoo, and Zalando - all similar in product categories but different in the first vs. third party products mix.

- Boohoo - Sell own brands only. Highest margins.

- Zalando - Sell third-party only. Lowest margins.

- ASOS - Sell a mix, ~70% third-party, ~30% own brands. For years have been in the middle, got a bit lower due to other factors.

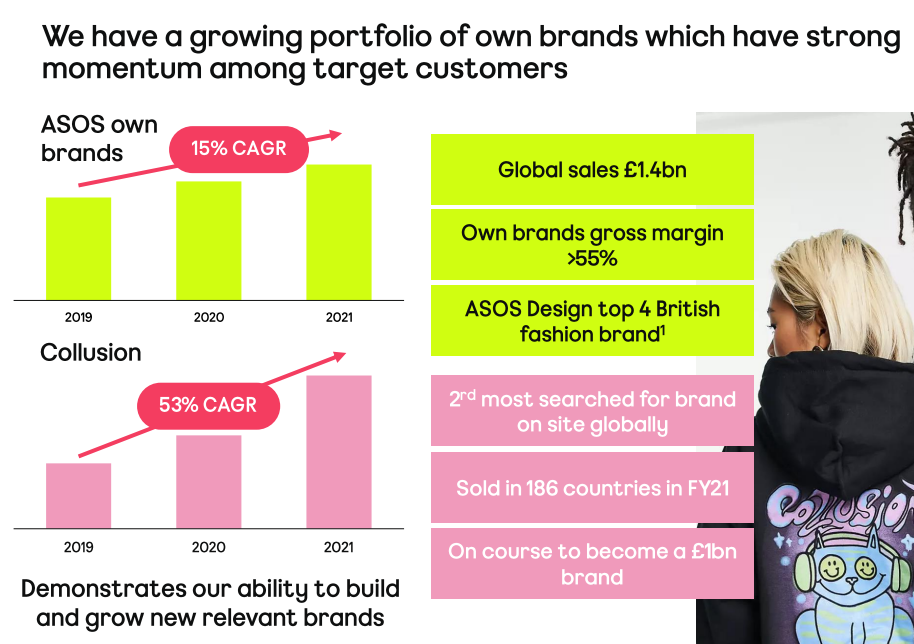

ASOS's own brands' sales have a healthy growth that is expected to go even faster following the acquisition of Topshop and the recent investments in the area after the Collusion brand success.

This should make ASOS margins better over time and the business more durable overall. A customer may come in to buy some third-party brand and end up adding an ASOS brand product to the cart.

Premium brands

Lululemon and Revolve have elevated margins because they target premium markets. The more premium the product is, the higher the margins. That's true for every market. Ferrari and Porsche have ~16% profit margins, while Ford stands at ~3.5%

Revolve, for example, makes ~139$ per customer vs. ~68$ per customer for ASOS. We can compare since both publish active customers and the number of sales for each period. Revolve sells products, on average, at almost double the price. The gap is probably higher in Lululemon, but we don't have the active customers numbers

ASOS will never be a premium/luxury brand, but it may enjoy some of the market benefits. AS I mentioned in my deep dive, ASOS is transitioning to be a platform that can give rise to any distinctive brand within it. Just as "Amazon" can sell both luxury and budget items - so will ASOS.

As ASOS focus on 20-something fashion, that can and will include luxury brands for the 20-something. It might be fully-owned brands like "ASOS Luxe", "Topshop" or third-party brands like "allSaints" and "Ted Baker" that already sell in the platform.

Gross margins: Bad investments, Supply chains, Inflation

In the past few years, the erosion of the gross margins played the most significant role in ASOS having operating margins lower than expected for their business.

Bad global expansion

Expanding to the global markets was rough, specifically with the new US warehouse in Atlanta. It was so bad that it accounted for most of the gross profits losses before COVID.

Here's Adam Crozier, chair of ASOS, from the 2019 annual report:

Over the last few years, the Company has prioritised investment in the right infrastructure, in the right places, to enable our ambitious growth plans. However, I am all too aware that this has impacted our financial and operating performance over the last 12 months. In short, we have disappointed investors and, at times, ASOSers. The complexity of transitioning to an international scale was underestimated, particularly with regard to trading across an expanded warehouse network, and this negatively impacted stock availability and sales in Europe and the US.

The good news is that the infancy issues with the US warehouse are mostly resolved by now. So moving forward, we should see improvement.

Supply chains & Inflation

I already wrote extensively about the supply chains of ASOS in the deep dive, and the inflation issues need no introduction.

Yet, the supply chain issues didn't affect any other competitor as badly as they did ASOS. What gives?

Well, bad investments compound badly. The inability of the US warehouse to operate correctly led to many products having to be delivered from the UK. This leads to ASOS paying shipping prices AND paying extra duty costs. The mess propagated to the EU supply chains, adding Brexit duty mess to the story.

All this is good news. Given that the US logistics are getting better - the compounding mess should be gone, too.

Growth

Here's the growth by market chart I made for the deep dive again: