- Pivot toward profitability with cost optimization

- Closing storage facilities, removing unprofitable brands, reducing marketing spend, layoffs

- Focus on balance sheet strength

- 2023H2 guidance to profitability

- Back-of-the-napkin valuation shows 2x opportunity

Oh boy, ASOS is quite the ride. My initial deep dive from April 2022 had the thesis of short-term turmoil that will end up in going back to growth in the long term. It may still happen - depending on how you define "long-term" - 3 years from now? Maybe. But for 2023 the plans are to stabilize the company and focus on profitability - actions that will inevitably lead to some revenue shrinkage.

Personally, I'm at an important decision point: I doubled down on ASOS at £5 and with the recent price rise to £7.5, that makes me almost break even. No win, no loss. No "loss" bias for selling now, but also no "win" bias. Coming to it with fresh eyes - will I commit to this investment?

Without this, I'd be -45% on my $ASC.L holding.

— Snir - Investing (@snird) January 14, 2023

Lucky for me, I made the right decision adding more at this price. https://t.co/7alvVVu9mq

In this post, I'll focus on their 1-year outlook: where the cost-cutting, and subsequent possible revenue shrinkage will lead us, and how I value this.

That is - completely neglecting the long-term prospects, which I already covered in my initial deep dive. So, you can check it out there.

ASOS cost optimizations

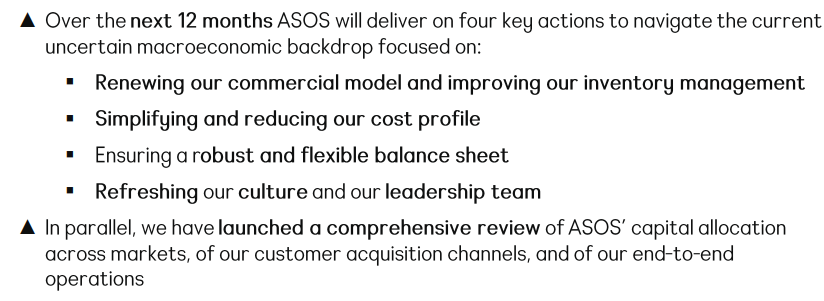

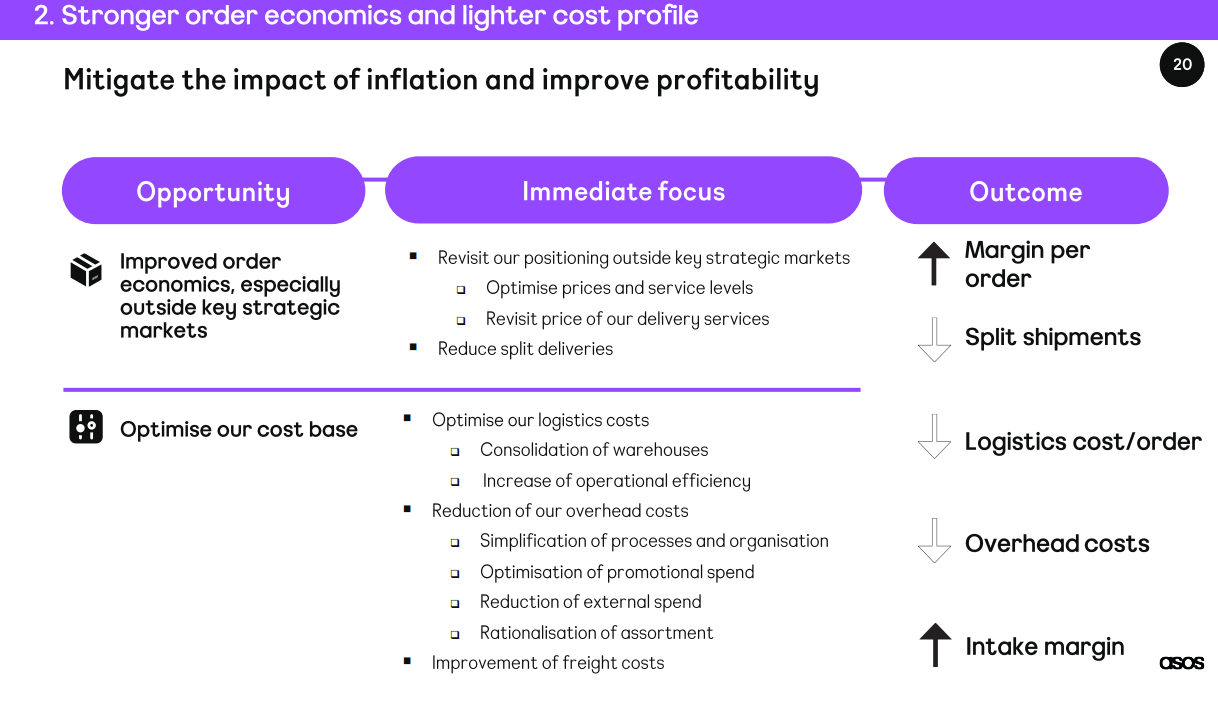

Back in October 2022, CEO Jose Antonio Ramos laid out his plan to optimize costs for ASOS.

He gave some extra details in the earnings call:

"We are going on our logistic costs. We are consolidating some of the ancillary warehouses, not the core warehouses, but some of the smaller warehouses that we're using to operate. We are using the opportunity to increase our operational efficiency and also the reduction of the stock will certainly help here, but we are also reducing our overhead costs. That is going to mean the simplification of processes and organization, the reduction of external support or the reduction of the rationalization of our assortment, therefore, the simplification of our operation."

These plans came through now, with the announcement of these actions:

- Closing 3 storage facilities (US, UK, Europe)

- Downsizing office space

- Removing 35 unprofitable brands

- Limit marketing spends only for good ROI campaigns

- Layoffs

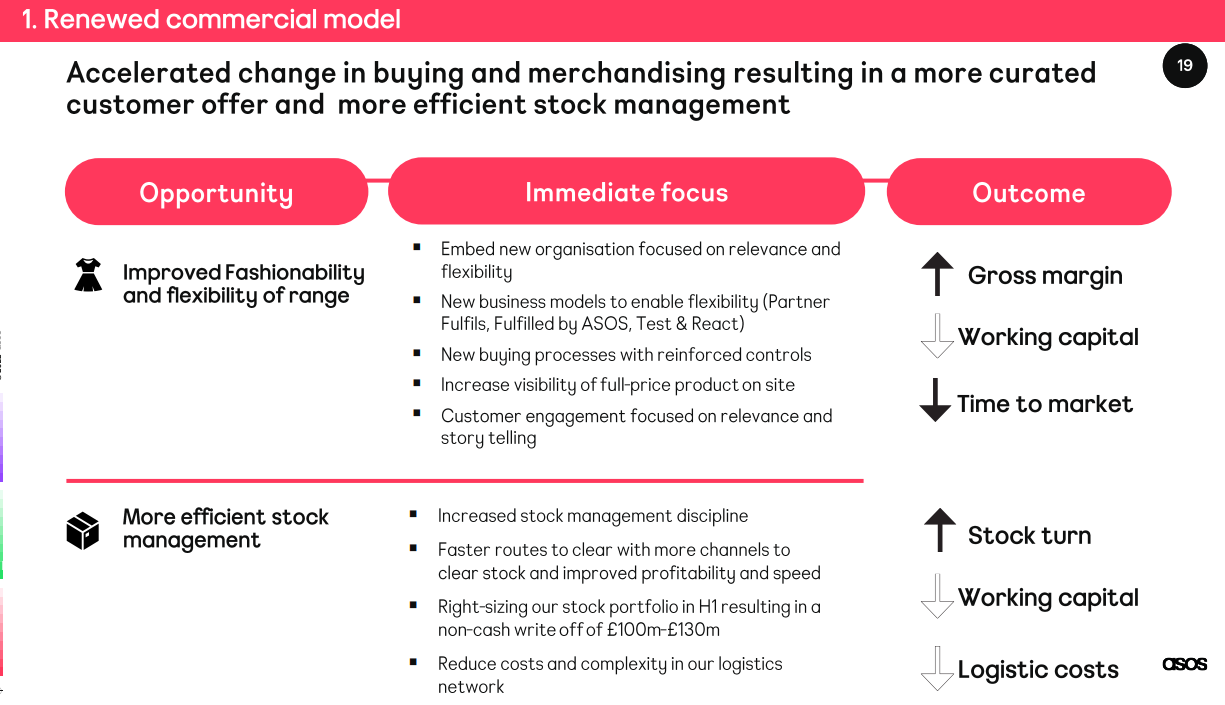

ASOS operations overhaul

To support the cost-cutting measures, ASOS had to change the way it operates. But this is a two-way thing, as the new operational plans are not just down-sizing due to cost-cutting, but adjusting the way they work to better leverage the new reality.

"We need to make sure that what we put in front of our consumers is relevant. It's contemporary it's the trend of the moment. Because if it's not, it's not fresh fish. And frozen fish is good, but it's not fresh fish, completely different business."

A focus on winning, fashionable items will make margins much better, and help costs go down. But it will cost ASOS in the "long-tail" customers.

Those "long-tail" customers are usually the non-profitable ones, but using the long-tail to onboard them into ASOS usually pays off eventually, as they become profitable a few years down the road. Think of it as "acquisition cost".

This will make the numbers so much better short-term, but will inevitably harm growth long term and lead to lower revenue short-term (which is the unprofitable, low or even negative part of the current revenues).

Personal experience

I order from ASOS often to see how things change, and to measure the quality myself. I live in Tel Aviv, Israel, which is a low-priority market for ASOS.

An order I made in September was:

- Delivered within 3 business days - air freight

- Was prompted by an Instagram ad - as an active customer, I was heavily targeted

An order I made 2 weeks ago:

- Haven't arrived yet (2 weeks) - sea shipping

- No ads, went to the site myself - marketing spend stopped

This is great. Israel should not be a priority market for which ASOS gives up their margins due to air-freight and marketing expenses.

And that will be the same for many other markets. It will lead to an inevitable sales drop, but those are low-margin, or even losing sales anyway.

Valuation

Given all that, let's try a back-of-the-napkin valuation. I'm targeting estimates for a year from now.

Better margins

All those cost-cutting measures and dropping of unprofitable markets will obviously lead to better margins.

ASOS may go from ~44% gross margin now closer to its historical ~49%.

Operating margins, currently flowing around 0% from the negative side, can go back to its pre-pandemic average of ~2.2%. But that was when the spend on growth was on full force. It might go higher, maybe even ~4%.

Lower revenues

Getting those better margins will be, in part, by throwing away "bad revenues". Getting out of unprofitable markets, lowering marketing expenditures, and giving up on some "long-tail" customers.

We already see it, with last results showing -30% sales on the ROW segment, due to completely dropping marketing and air-freight there. I expect the trend to continue throughout this year.

ASOS currently sits at ~$4.5B in sales a year. The optimist in me expects ~$4.2B this year, but the margin-of-safety guy in me says ~$3.9B.

P/E valuation

ASOS current market cap: $750M

Bullish:

$4.2B revenues at 4% profit margins = $168M net income = 4.4 P/E.

This seems very, very low. If this comes to be, we can expect an easy doubling. But I would NEVER count on the bullish expectation to happen.

Bearish:

$3.9B revenues at 2.2% profit margins = $85M net income = 8.8 P/E.

This is no longer such a clear-cut. Assuming revenue shrinkage, the market may not reward ASOS with a nice P/E even though they'll improve margins.

The market often assigns P/E of 12-16 to such companies, but it can also hover around 9. Which means ASOS may be at a fair price right now if the bearish scenario is the one to be.

Relative valuation

A fashion company, on the European market, struggling with margins and having revenue shrinkage to compare to?

Lucky for us, Zalando is exactly that. But Zalando has their profit margins around ~2% already - where we expect to be with ASOS in the bearish expectations.

According to the valuation multiples Zalando receives, ASOS is traded somewhere between 1/2 to 1/3 of the valuation. E.g: EV/Revenues - Zalando: 1.01X, ASOS: 0.32X.

If ASOS gets to my bearish estimates, and it will trade similarly to what Zalando is getting, it may double to even triple in price.

Verdict

I will keep my money with ASOS for the next year, seeing how things develop.

I feel that the risk-reward here is good enough for the sizing in my portfolio, and that the probability for a good outcome given the current situation is good enough.

I may be wrong, and my bearish estimates aren't bearish enough - but I feel that even then, the losses won't be too harsh.