In November 2020, I picked up 4 stocks using the Magic Formula and Acquirer's multiple in a process that took less than an hour. Here are their performance to date:

- $LEU - 182.8%

- $PUMP - 109.3%

- $XNET - 74.8%

- $ASMB - -26.3%

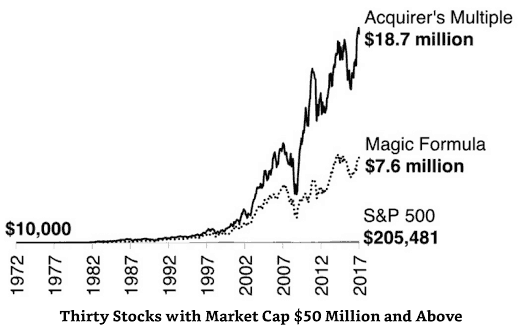

Any quantitative approach for the stock market has good and bad periods. The Magic Formula / Acquirer's Multiple, as value (or deep value) methods, had a good run in 2020, which was somewhat expected by most (and why I got in with this experiment too).

I will cover what the Magic Formula and Acquirer's Multiple are, why it worked so well this time (but haven't for the past decade), and why I won't pursue this approach long term despite the outstanding performance presented.

What is the Magic Formula

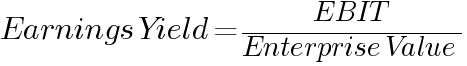

In 2005, Joel Greenblat published his book "The little book that beats the market". This book lays out a quantitative formula for screening stocks that he showed through research and by applying it himself to beat the market performance.

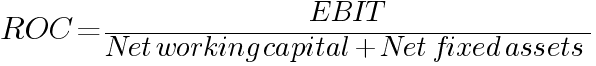

The formula is based on 2 variables: The Return on Capital (ROC) of the business and the earnings yield.

Return on Capital (ROC)

Return on Capital measures what is the proportions of return a business makes from capital deployed. For example, if a business builds a factory for $80k (fixed asset) and then buys $20k of material (working capital, without having anything else for simplicity) - which results in products sold for $10k - that's 10% Return on Capital.

If the business would have sold $15k worth of goods - that would be 15% ROC. The higher the ROC is, the better.

Earnings Yield

The earnings of the company are divided by the price of the company. Well, not exactly the price, rather the enterprise value. The enterprise value doesn't just look at the price to buy the company but considers its debt and cash holding.

A company earning 10$ with an enterprise value of 100$ will have a 10% earnings yield. The higher the Earning Yield, the cheaper the company is compared to its earnings power.

The Magic Formula ranks companies based on having a high Return on Capital and Earning yield. High ROC marks businesses that make good use of their assets to drive return, making them good companies while having a high earnings yield, which means their price is currently low.

The story makes sense, the formula is simple enough, and backtesting proves that it significantly beat the market.

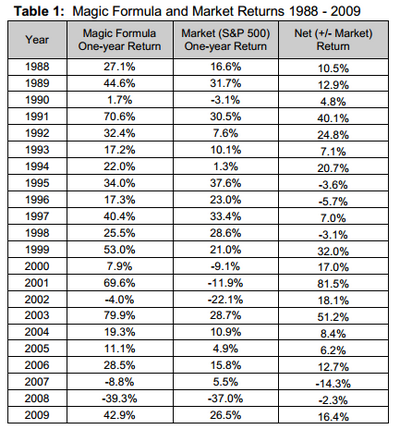

The Acquirer's Multiple improvements

Tobias Carlisle, the author of "The Acquirer's Multiple", did some additional testing and figured out something that is both remarkable and simple:

If we drop the ROC measure and focus only on buying companies with high Earning Yields (what is known as deep value), we can get even better results.

A reversion to the mean story

The Magic Formula strategy includes another crucial step: a year after you bought businesses with high magic formula ranks, you should sell them.

This step is baked in because the magic formula fundamentally looks for temporarily mispriced stocks in the market. But, unfortunately, it doesn't look for quality businesses that you should hold for the long term.

Therefore, it expects that the mispriced asset will be reversed to its mean value within a year or so, and in the process, you'll make money.

Buying stocks only to flip them so fast is where most of my issue with the Magic Formula is.

Selling and paying capital gains taxes is a compounding breaking event.

— Snir David (long term investing) (@snird) June 26, 2021

A company that grows steadily that we don't have to sell is far better in this regard.

Selling is a heavy tax event, all while you need to find new companies with the formula each time, and this formula isn't consistent. It is for the very long run, but there are years or, as most recently, a decade (2010-2020) where it fails to beat the market.

A great company that appreciates consistently, even if at a slower pace, is a better investment long-term. You don't have to sell it and pay capital gains taxes every year. It naturally compounds on itself as it grows, and it's easier to stick with as time your understanding of the business will grow - allowing you to go through market volatility calmer.

This is the main shifting idea that Munger suggested to Buffett, who use to buy companies with a "similar" formula approach, that of Ben Graham.

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." - Warren Buffett.

What I did - how I picked the stocks

I elected to go with the Acquirer's Multiple, screening the top 20 non-financial companies in the US with the best score. Of those 20, I selected the best 4 that didn't look like in a very, very bad place.

All of the companies screened had something bad happening to them, or else they wouldn't be in such a sale. So what I filtered out was things I decided were detrimental - A CEO & CFO accused of conspiring in a hate crime, A company under investigation for vast fraud, things like that.

The backtesting that both Joel Greenblat and Tobias Carlisle performed didn't include such additional filtering. They warn against doing this kind of filtering, explaining that the best performance is usually for companies that seem in such a dangerous place that turns out not to be so.

Why it didn't work for the last decade

Simply put, quantitative mechanisms that focus on a specific aspect are dependant on the market relations with that aspect measured. In the Magic Formula case - traditional value investing, that didn't work out so well compared to growth in the last 10 years.

Joel Greenblatt mentioned in the book that the Magic Formula fails to work every 4th year and loses at least 5 months of every year. With the last update of the book coming out in 2010, coincidentally, the year it stopped working (at least in the sense of beating the market).

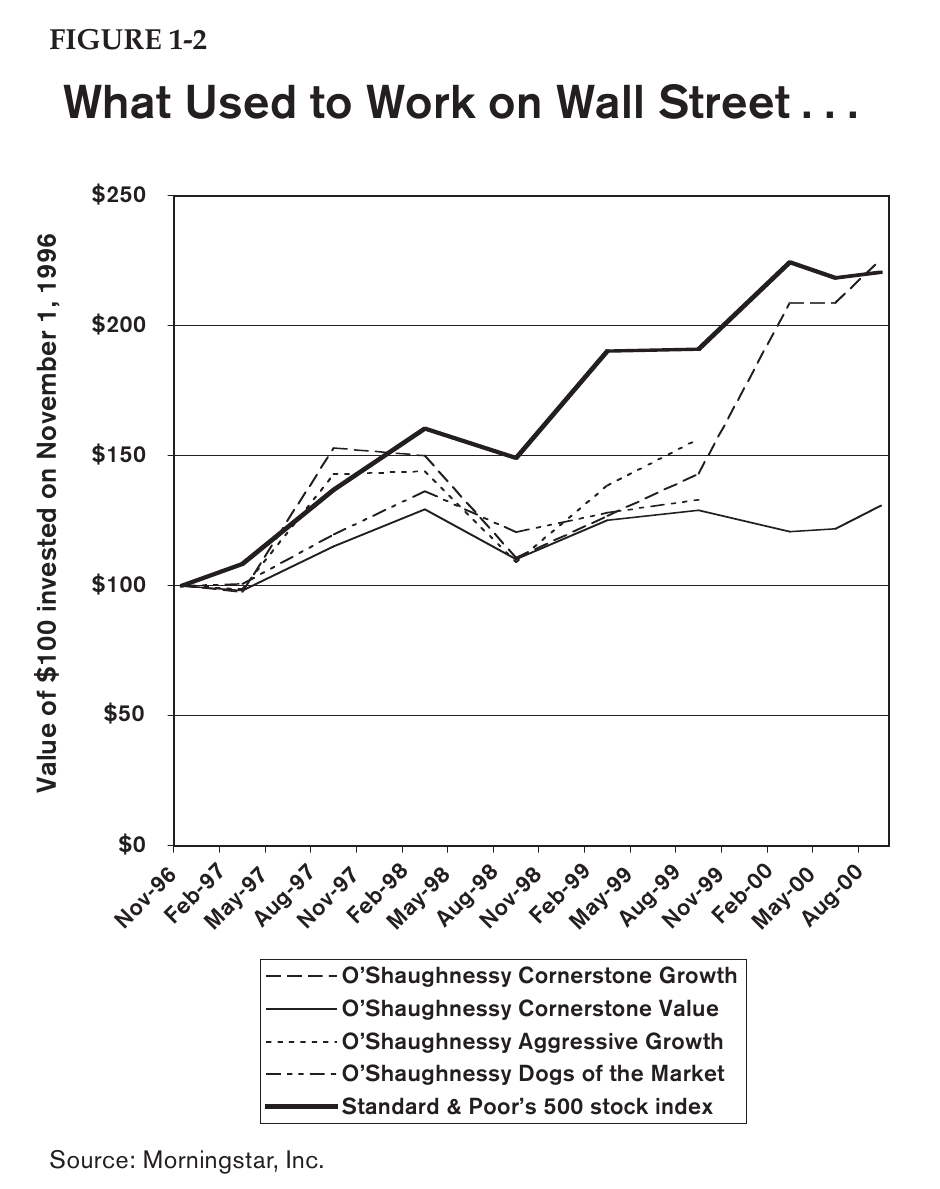

Another book that utilizes quant mechanisms in its research is "what works on wall street" by James O'Shaughnessy. It shows there multiple mechanisms and then focuses on one that "works consistently".

O'Shaughnessy then opens a fund based on these mechanisms in 1996 to discover they stopped working as soon as he started using them.

Things got so bad that he had to close the funds in early 2000. Granted, this wasn't his fault at all - for the same reasons that the Magic Formula didn't work out for a decade, he just bumped right into the period that his chosen formulas didn't work.

In his commentary to "The intelligent investor", Jason Zweig wrote about it, which I recommend reading for more context.

Why it works now

After the big crash in March 2020, the markets recovered at a spectacular pace. But not the entire market - mostly tech and growth stock led the rally.

This market discrepancy left most of the "value" companies so much behind that they were underpriced. A tool like the Magic Formula can be helpful to capture value out of this discrepancy.

In these terms, 2020-2021 was an "easy mode" for using these tools. That explains the extreme returns I made but also means that we can't expect such returns going forward.

Does the "10 bad years" of the Magic Formula behind us, and will it perform better and more consistently moving forward? Maybe.

But for me, as an individual investor that can research companies, I prefer paying fair prices for great companies that will compound over the years. This lesson from Charlie Munger and Warren Buffett is a valuable one.