DISCLAIMER: ASOS is now the biggest position in my portfolio. I researched it for months now. This is my research and why I decided to make it my biggest position.

ASOS is an online fashion retailer from the UK. Their brand specializes in 20-something fashion. It has also become a fashion platform for many brands, not only ASOSs'.

ASOS has a massive share in the UK market, where it started and applied its strategy successfully for over 20 years. They have a good presence in the European market and started penetrating the US market in the past few years. Their growth in these markets holds massive potential.

The company is recently out of favor, with over -60% hit to the stock price since its highs. Supply chain issues make their recent expansion to the US market harder and generally hit their global operation. Brexit didn't help their trade situation with the European market either as a UK company.

The online fashion retail market suffers a hit as COVID restrictions go away, and people prefer to spend their money on restaurants, travel, and other "real world" experiences. Resulting in the growth numbers seen in 2020 due to lockdowns going away.

And if that's not enough, the CEO of 5 years recently left the company, leaving the company without clear leadership in the most trying times - when they have to figure out supply chain issues amidst their global expansion and growth in the US market.

That all being said - I believe that ASOS is a great business that will overcome all its short-term issues and will show significant growth in the long term.

The stock price is in a position that can offer great returns for a turnaround or minimal losses in the doom and gloom scenario - as this scenario is already priced in.

Company overview

ASOS is a UK-based online fashion retailer founded back in 2000. It can be best defined as "Quality, ethical, 20-something fashion at any price".

Diving into each definition item separately offers a great way to understand the company, its value proposition, and thus its moat. Let's dive in, into "Quality", "Ethical", "20-something", "Fashion", and "At any price".

Definitions

Quality

ASOS products are made from quality material in quality processes that ensure the end products are consistent, reliable, and held for a long time.

That comes into context when compared to other competitors like SHEIN and Boohoo. I asked >100 people who bought there and tested some products myself. In terms of quality, they are objectively worse. They also provide high-quality products, but the perceived brand and focus are not of quality.

To quote a Redditor who put it out perfectly: "Washing SHEIN stuff before first wear already destroys half its life".

Products can be made as cheap as possible, but not cheaper.

— Snir David (long term investing) (@snird) March 10, 2022

ASOS $ASOMY are making great fashion as cheap as possible while having high quality.

Shein makes things too cheap.

Here's one example of a discussion at r/femaleFashionAdvice, and most discussions are similar. pic.twitter.com/Wb7F7pQtrY

SHEIN has a premium brand called MOTF, but to quote someone I questioned about it: "You have to be INSANE to buy premium from SHEIN. They are the cheap-Chinese-sweat-shop brand. Not premium."

It comes down to this: nobody will brag about a quality buy from SHEIN, Boohoo, and I dare say even Fashion Nova these days. But they will from ASOS.

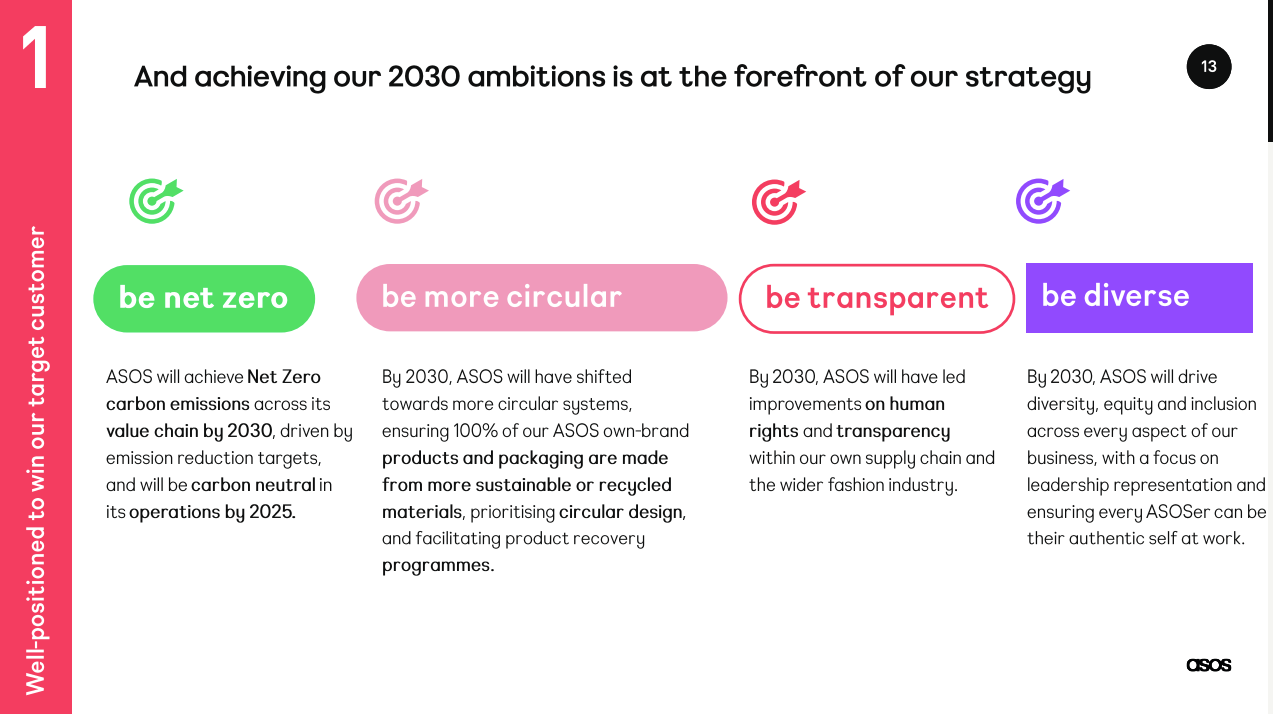

Ethical

The 20-something fashion-oriented audience cares about sustainability, environment, diversity, and generally buying from an ethical brand.

This has its limits, and it might affect mostly the more premium buyers, but it exists. Even if just for the virtue-signaling, being able to say your fashion is ethical is an integral part of the brand.

The ethical aspects come into context, again, with competitors in mind. Every girl buying SHEIN or Boohoo that I talked to felt obligated to say "I have to do it for the price! Once I finish my studies/get a better job, I'll never shop there again."

SHEIN runs the most unethical sweatshops in the industry, while Boohoo made their "sweatshops" in the UK. And while other competitors can at least deny being THAT unethical, none can claim ethical workings like ASOS can.

20-something

The focus on a limited age group further solidifies the ASOS brand. The 20-something is the most profitable market for fashion selling, and this age group is inherently exclusive.

A 20-something fashion-forward person will avoid any association with any other age group. A 30-something doesn't mind buying in GAP, while a 50-something is in store. That's not the case for 20-something fashion-forward people.

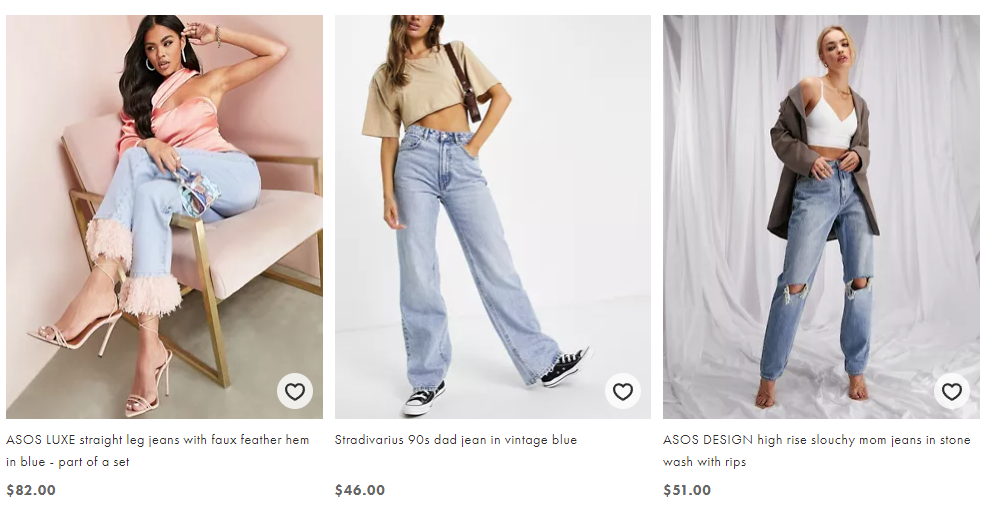

ASOS maintains tight control over its image as a 20-something brand that it's impressive to watch. For example, all their marketing materials and models showing the products on their site strictly speak to their target group.

Sorry to pick on SHEIN again, but that's an excellent way to show how mass production, in their case, comes before brand control: They have an incentive program to make customers send photo reviews of products. Making a product presented by a 20-something model followed by a 50-something customer photo in the reviews.

It helps sales for low-quality cheap assets, but it destroys any perception the platform tries to make. That's something ASOS never does.

Fashion

The word "fashion" often loses its meaning in the retail context, as even a mass-produced generic product is called "fashion". No, for ASOS, fashion is FASHION. It's being trendy and new. It means something.

Combine that with the "20-something" and "quality" values, and you have a unique proposition. The result is a unique place that understands and communicates fashion while making its customers feel good for being its customers.

Other brands fail to communicate "fashion" for various reasons. These reasons can be quality (SHEIN, Boohoo, Fashion Nova to some extent), values (SHEIN and Boohoo sweat shops), presentation (Revolve), and more.

One great example of how ASOS understands fashion is why Adidas considers them a strategic partner. This is how the same product is presented in Adidas vs. ASOS:

Good presentation isn't trivial at all. Here's the denim category at Revolve, for example:

And here it is at ASOS:

You can be as fashion brain-dead as me, and still able to tell which one communicates "fashion" more.

At any price

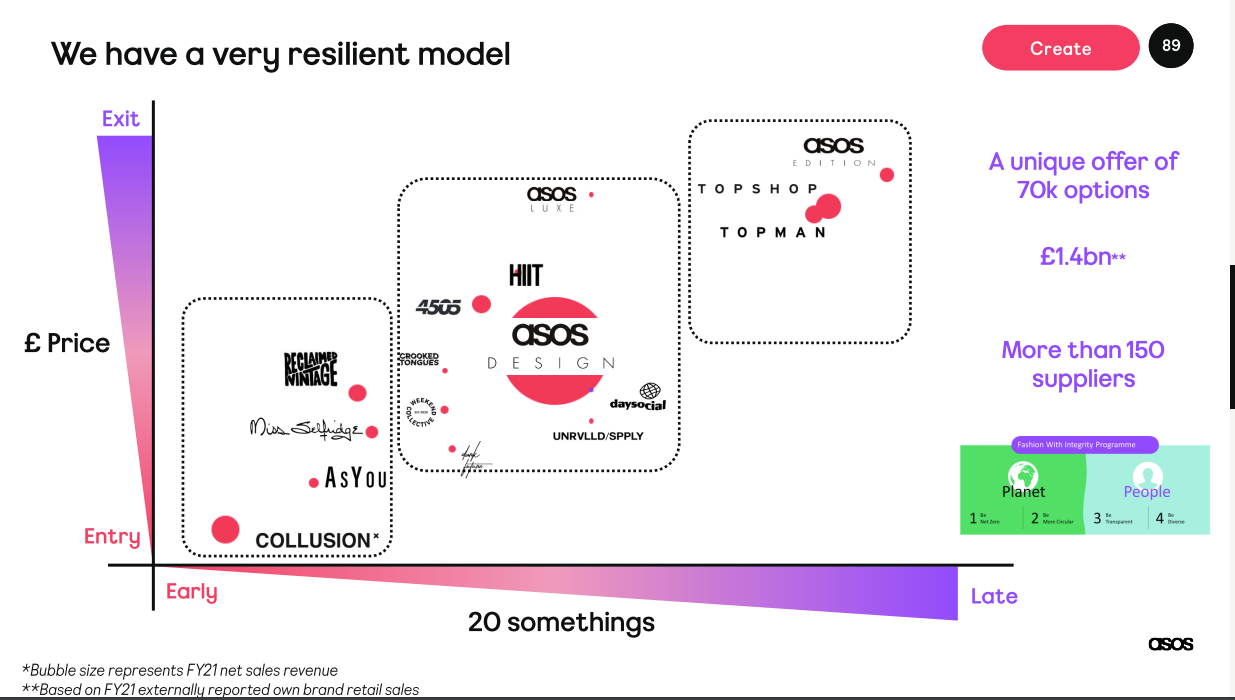

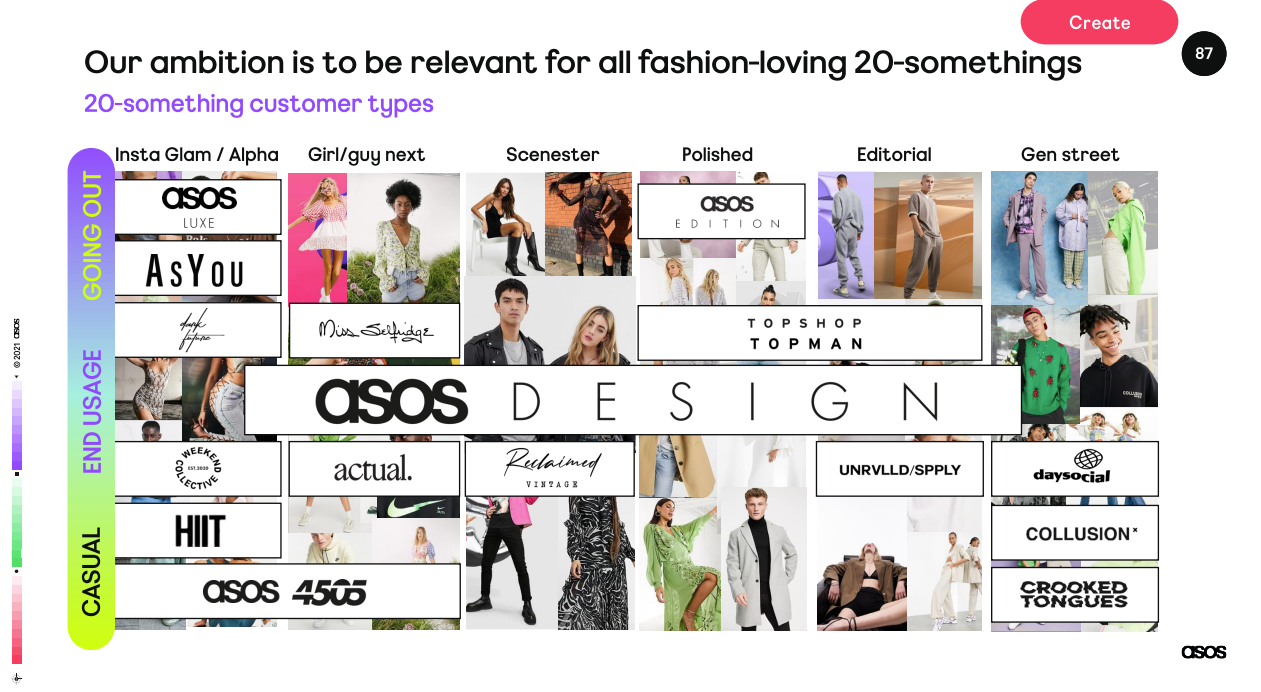

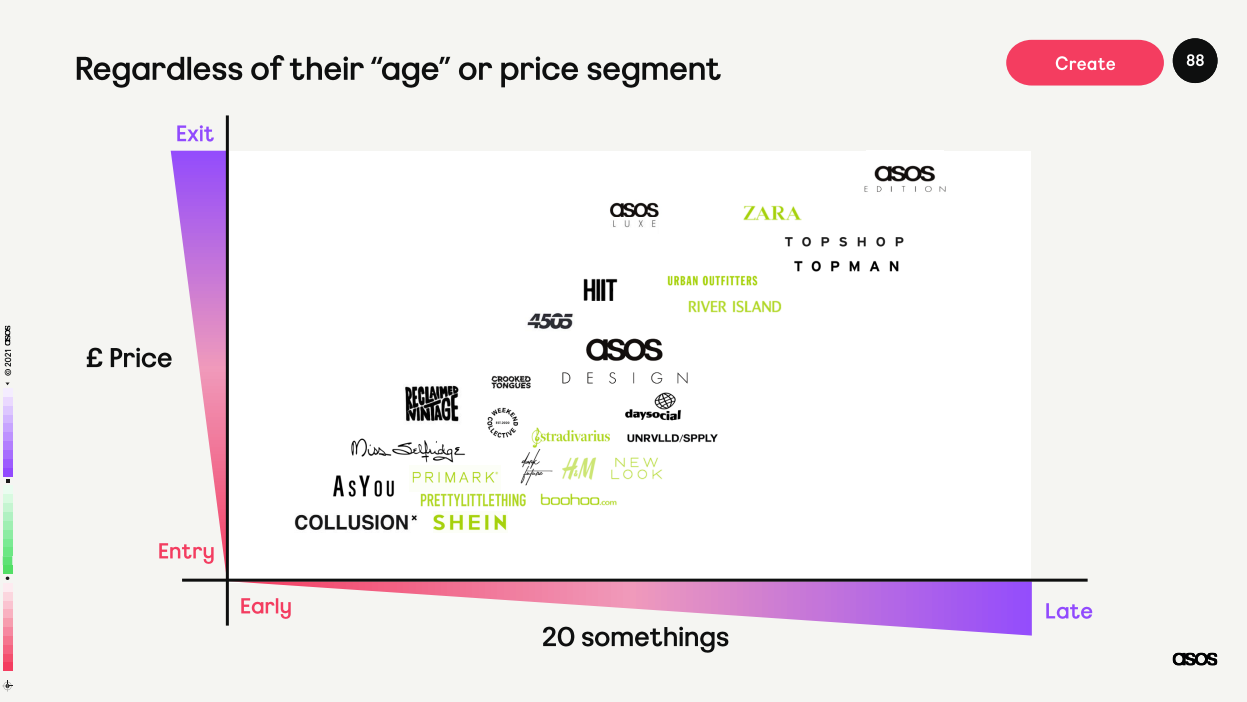

ASOS has many brands, spanning all price points and sub audiences within the 20-something range.

This slide from their last Capital markets day describes it best:

While most of their sales come from the "ASOS Design" brand that targets mid-20s at a mid-price point, they also have brands for other price points.

"COLLUSION*" brand is the younger and cheaper brand, launched just a year ago - and is already the 2nd most selling brand in ASOS. That is to speak to its quick growth and potential.

The "Topshop" and "Topman" brands that ASOS acquired recently represent the high-end alongside "ASOS Edition". These brands are unique and recognizable outside of the "ASOS" brand - helping acquire customers in the US, but we'll get to that.

I'll finish this section with a quote of Matt Dun, ASOS COO, from the capital markets day (at 10:30):

We believe what differentiates us is that we do 20-something fashion with a focus like no one else. That doesn't mean sacrificing our "Fashion with Integrity" principles to be the cheapest in the market, nor does it mean correcting the widest possible range. Instead, our whole strategy is focused on Gen Z and Millennials and having the most relevant product for them at relevant price points with relevant propositions, such as the on-site experience and delivery methods tailored to their needs.

Markets

First look at markets spread from the latest sales figures for Q4'21:

As a UK based company, it's natural for most of the sales to come from the UK. The other segments, EU, US, and ROW (rest of world) are the essential future growth for ASOS.

ASOS is a market leader in the UK, but not so much in other regions. To be a market leader, ASOS needs 2 things to work properly in a region: marketing and logistics.

In the UK, they have 2 fulfillment centers for the logistics and over 20 years of marketing to that audience. So it works best. The challenge is replicating this in other regions.

Let's complete the markets picture with some growth figures to get a sense of what's happening:

Here are a few takeaways from this data:

- Amazing growth in the UK

- Moderate growth in EU, US

- The last year or so was horrific. No growth, and decline in the ROW segment

Last year's growth stop is primarily due to supply-chain issues, which we'll expand on later. But it was most devastating to the ROW segment as it had elevated delivery times, often for weeks - resulting in the decline in sales.

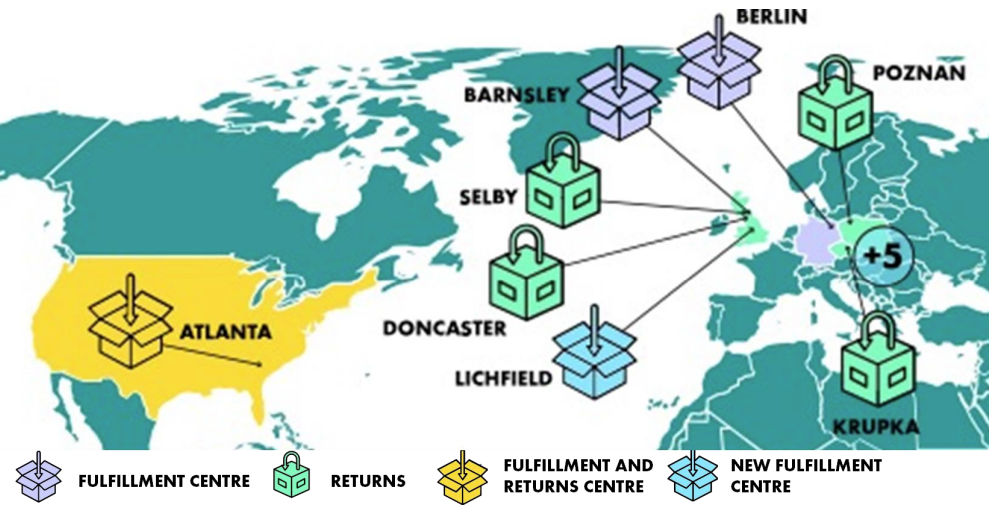

Logistics

Good logistics infrastructure enables global fashion commerce to be reasonably priced with good experience. When I think about logistics, they affect these factors of the business:

- Delivery time - Having next-day delivery is crucial in fast fashion

- Product availability - With global logistics, some products may be available only for certain regions. A good logistics infrastructure will make the right product available at the right time

- Returns service - Online purchases naturally have high returns ratio, processing it efficiently is crucial for the bottom line

As the economies of scale rise in certain markets, it justifies more infrastructure in those markets - making all the points above more achievable and for a better price and thus margins for the company.

Logistics infrastructure requires heavy capital expenditure. ASOS ramps up new logistic centers slowly in a way that justifies the spending along with the market growth. It starts slow with partial operation, manually, with few people. It eventually grows to be full capacity, fully automated logistics centers.

This also means that efficiency in new locations is typically low - harming margins. But so does massive capex before it is called for - so I trust ASOS management in this regard. The point is that as each market grows and its logistics centers mature - its margins get better.

Logistic centers

UK

UK is currently the biggest market for ASOS, so it's naturally the home of most of its logistics centers.

Barnsley - ASOS's biggest and most significant fulfillment center. It provides service in the UK, MIDEA, and South America. As the most significant logistics center, it also supports all other fulfillment centers. Here's a quote regarding the US market from the last annual report: "We increased the range of products available via ASOS Fulfils, which augments the stock held in Atlanta from Barnsley."

Lichfield - First opened in August 2021, this is the newest fulfillment center aimed to support Barnsley in the UK market. It still isn't fully automated or at full capacity, as its operations ramp up slowly with demand.

Selby, Doncaster - Returns centers of UK. In charge of cleaning, repackaging, and making returned products ready for sale again. As a result, 97% of ASOS returned products go back on sale. After the products are ready, they go back to the fulfillment centers.

EU

Berlin - Also known as the "Eurohub" in ASOS reports, it serves the EU market, and is the second biggest fulfillment center.

Poznan, Krupka - The EU returns center locates at Poland.

US

Atlanta - The US logistics center, both fulfillment, and returns center. The operations in the US are still limited, so it makes sense to have both in the same center. In addition, this warehouse makes 90% of the US population eligible for next-day delivery.

Warehouse automation

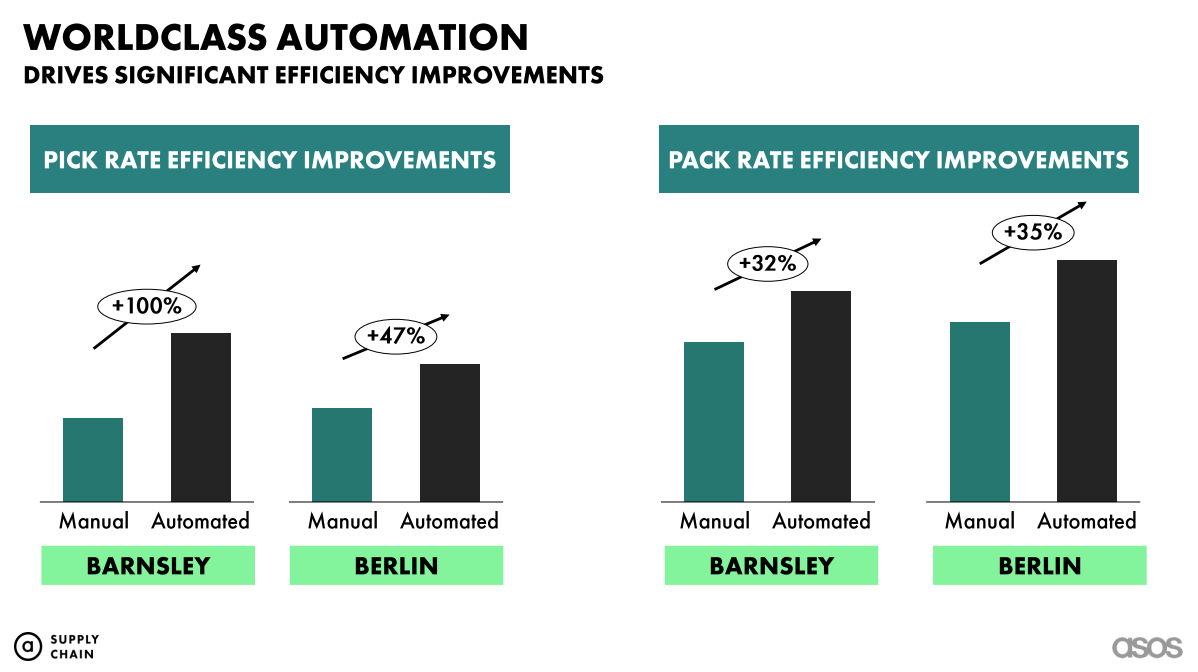

Adding automation to a warehouse is very capital intensive, so it was done only for the Barnsley and Berlin center so far. The gains in productivity are impressive:

It's easier to understand what automation means when you see it, this video from ASOSs' Supply Chain event makes it clear:

Automation for other fulfillment centers is already on the way, with the US Atlanta center fully automated by 2023, and the Lichfield center is starting the automation works now.

The automation technologies are all third-party, yet all the data gathered is wholly owned by ASOS, opening the opportunity for data-based optimization and AI tools in the future

Fulfillment schemes

One fulfillment center serves each market. That's the easiest scheme, easy for the company to manage and coordinate, and easy to communicate to the customer.

But ASOS now goes beyond that, in more complex customer orders fulfillment schemes that enable more possibilities for the customers. With logistics and software to make it all seamless for the customer - ASOS is a unique leader in this field (among fashion retailers. Come on, no one competes with Amazon on this).

ASOS fulfill (flexible fulfillment)

Allow customers to shop items from multiple fulfillment centers at once.

In 2020 ASOS started a pilot in the US of orders fulfilled from any warehouse. Items that aren't available in the Atlanta warehouse are sold to US customers from the UK or Berlin fulfillment centers. This also works the other way around, but it's most significant in the US.

This pilot that made more products available to the US market leading to 37% more sales. But more importantly, it proved the logistics ability to serve the same customer from multiple fulfillment centers at once without any major inconveniences to the customer. So that's another step toward global logistics infrastructure.

Fulfilled by ASOS

Allow partner brands to host their products within ASOS fulfillment centers.

ASOS allows partner brands to use ASOS logistics centers for products sold on the ASOS platform. This enables brands that lack global logistics power to have an online presence through ASOS.

Smaller, local brands benefit most from this program. From the ASOS side, it allows for local targeting in different markets, bringing growth and customer acquisition opportunities for customers already familiar with their local brands.

Partner fulfill

Partners serve customers on ASOS platform from the partner fulfillment center.

In 2021, ASOS ran a pilot for this program, in which partner brands (Adidas, Nike, etc.) serve the customer directly from their logistics centers rather than go through ASOS logistics.

Now in 2022 the program is out of pilot and getting incorporated officially. In a question from Jan 2022 call, Mat Dunn (CFO, COO) said this:

In terms of the learning on Partner Fulfils, there were 2 reasons to run the pilot: One was to make sure that we could successfully execute, and it was a good experience for customers. And I think we're really confident with the way that experience takes for customers. So in that sense, it gives us the confidence to move -- to roll it out, and that was one of the key elements of the pilot.

With "ASOS Fulfills", "Fulfilled by ASOS", and "Partner fulfill", this customer journey at ASOS is now possible, in a single order of 3 products:

- "ASOS Design" brand product (owned by ASOS), delivered from ASOS Barnsley warehouse.

- "Adidas" product delivered from ASOS Atlanta warehouse.

- "Nike" product delivered from a Nike warehouse.

All coordinated, tracked, and supported through the ASOS platform.

ASOS as a platform

ASOS north star is to become the definitive location for 20-something fashion. This goal is unique because it puts the customer in the center and ASOS's actions toward that goal sometimes seem counterintuitive in the broad market context.

Most competitors choose to either have full control of the product offerings, selling their brands only (SHEIN, Fashion Nova, Boohoo, etc.) or be a marketplace for others (Amazon, Etsy, Stylight, etc.). ASOS does both.

Being the "definitive location for 20-something fashion" requires recognition that fashion will always be bigger than you - it has to include big, global brands such as Adidas and small, local brands that set the fashion tone in specific regions.

This isn't merely an extension of ASOS as a marketplace - they take ownership of everything sold through them to make it the best fit for the "definitive location for 20-something fashion". Marketing, logistics, discovery - ASOS take full ownership.

Marketing

ASOS has a highly polished pipeline for fashion marketing, from professional models and photography studios generating the "ASOS feel" for fashion to their social media management, and smart ad spend.

Targeting the 20-something fashion lover audience is a unique quality many big brands are unable to do internally at scale, so leveraging the ASOS platform for it makes sense.

Logistics

"Fulfilled by ASOS" and "Partner fulfill" schemes provide the best experience for both the partner brands and the customer.

If needed, ASOS can offer its logistics solutions through "Fulfilled by ASOS". And should the partner want to serve from his logistics center, the "Partner fulfill" capabilities are so well integrated into the ASOS pipeline that the customer won't feel any difference in the quality of service he gets.

The many brands of ASOS

"ASOS" is a brand in and of itself, but internally they have multiple clothing brands, each focusing on certain style, price point, and audience. When customers surf by category, "dress", "denim", etc., it's hard to create brand recognition for any specific brand.

But that's exactly what ASOS is trying to do - instead of "ASOS" being the clothing brand, it should be the "platform" brand in which you can find many fashion brands.

This is most notable with the acquired "Topshop" and "Topman" brands that have distinctive brand recognition globally. So much so that ASOS is leveraging this brand recognition in a strategic partnership with Nordstrom to sell these and other ASOS brands in their online and brick & mortar stores - getting a foothold in the US market through this brand recognition.

Other than the Topshop brands, ASOS has many other brands. Most recognized today is "ASOS Design", followed by "COLLUSION*", which is fast-growing, and ASOS announced its intentions to make it a differentiating brand.

If that works, ASOS will complete its transition to being a platform. Whereas now it's a shop - it'll become a mall. Instead of "This top is from ASOS", you'll say, "I went shopping at ASOS, got this Topshop top, COLLUSION* pants, and Adidas shoes.".

These 2 slides from ASOS explains the brands distinction:

The lightning round

Things you should know about the business but are not important or big enough to merit a section for them:

- Premier - For 10 GBP a month, a customer can get a premier status that offers special promotions, services, and access. Premier customers are highly engaged shoppers - and this keeps them happy. It's expanding fast - maybe there's a "Costco" or "Amazon Prime" scenario here.

- Face & Body - A fast growing category in ASOS, everything face and body, from skin care to make up through nails. According to ASOS, it doesn't help much with new customer acquisition, but it helps with retention of existing ones.

Supply chains

ASOS's core business relies on supply chains from two perspectives: the supply of products to logistics centers from the manufacturing sites and the supply of products to the end-users from the logistics centers.

The entire world is dealing with this issue now. But ASOS is especially out of luck - recent expansion to the US, Brexit problems with EU trade, fast fashion inherently relying on fast delivery, etc.

The wide supply chains issues

ASOS hosted a supply chains event in August last year, showing the supply chains issues.

Most of it is irrelevant by now. Supply chains issues got worse, and some plans are impossible now. For example, it makes no sense to move some deliveries from sea to air now that you can't fly with cargo from China to the UK through Russian territory.

Since this thing develops quickly, and since every retailer suffers similarly, I think it will be more productive to focus on how ASOS is uniquely positioned in this situation.

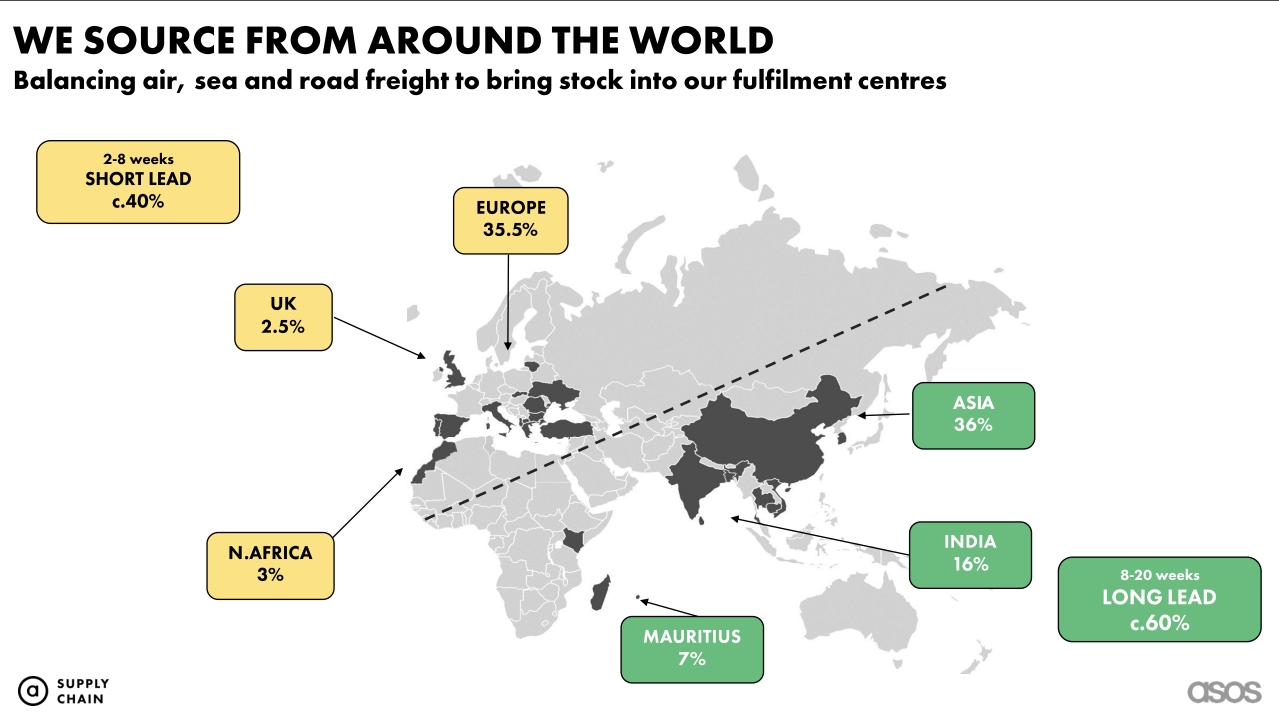

The most relevant and interesting bit of data is this:

Interesting points:

- Ukraine was a sourcing location, no update on how big of a sourcing location it was or what's its status now.

- China is the single biggest producer with 36%.

- What's being produced in Europe mostly move to the UK, some kept within Europe in the Berlin center. But things that go to the UK sometimes go back to Europe again.

Brexit

ASOS is UK-based, with its biggest logistics centers in the UK and Europe being ASOS's second-biggest market.

Brexit made all this trade that much harder and costlier, though once trade paths are figured out, it makes things easier. In the ASOS case, we're almost there.

US market infancy

The US market is still very small for ASOS. It has not reached a point where it enjoys economies of scale, making the supply chain issues in the US harder, making the whole business even more expensive, and cutting more into the margins.

In the supply chains event I mentioned above, back on Aug 21', executives said this is an issue. If it was an alarming issue back then, it might be on the verge of catastrophe by now.

It might make the operations in the US so ineffective that it'll lose money in the short term. The warehouse investments, supply chains costs, the commitment to the partnership with Nordstrom, and marketing spend - all contributing factors.

It's already mentioned as a headwind to the US market growth. This growth holds the most lucrative growth potential for ASOS.

Fast fashion

Fast fashion, and trendy, "living in the now" fashion especially, relies on fast cycles from ideation to sale. This rapid cycle is hindered when shipping from production to purchase takes two months.

This issue is unique to ASOS because of its trendy fashion focus. Other competitors' core customers are casuals that'll buy whatever. ASOS's core focus is trendy fashion.

The effects of the supply chain issue

ASOS will prioritize customer retention and growth in the short term rather than profits. That means they will take on some of the costs, harming the margins.

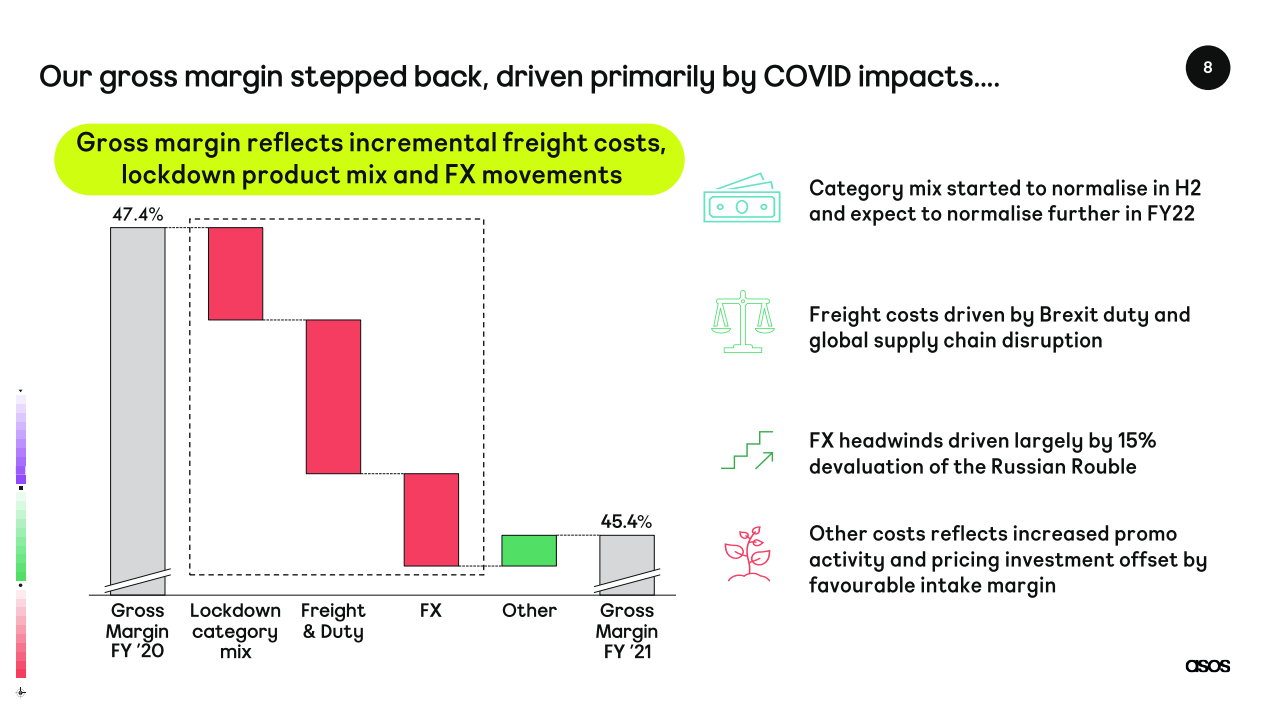

Operating margins are down from 7.0% on Aug 20' to 4.2% on Aug 21'. Again, that's all supply chains and inflation - as operationally, ASOS became more efficient in that period.

Gross margins are a better indicator to isolate supply chains, and they are at a decade low. Typically sits at 48%-52%, they are now at 45%.

The margins will go much lower still. It's hard to predict how low, as it also depends on the management strategy, which is without a CEO.

ASOS had times of low margins before and even a slide to loss territory most recently at the end of 2017. ASOS might slide into the loss territory again in the next 12 months.

Given all the headwinds and capital expenditure related to the global expansion, it's hard to see how they'll get away without moving to the loss territory.

Management

No CEO, No Chair

In October 2021, ASOS announced the CEO Nick Beighton will step down. A few months later, by August 2021, the board chairman Adam Cozier stepped down too, to take a position as chair of another company.

This left an obvious void in the company leadership. Exactly when experienced leadership is sorely needed - to overcome the supply chain and inflation headwinds. The market is spooked by the lack of leadership, too - upon the CEO resignation announcement, the stock dropped -20%.

While the chairman position was immediately filled by Ian Dyson, as noted in Adam Cozier last letter:

I hand over the Chair to Ian Dyson, who has been our Senior Independent Non-executive Director since 2013. Ian is the right candidate to oversee the next phase of growth, working with the existing Executive team to support the delivery of the global growth strategy.

The CEO position on the other hand, had not been filled yet.

Going global, handling supply chains

The new CEO of ASOS will have to handle the operational challenge of the supply chain issues and the global growth. The US market is key for the company value growth, and is the one most hurt by the supply chain issues.

Growing operations in neighboring Europe, especially while UK was still part of the union, is easy compared to bootstrapping operations beyond the pacific in the US. And the US operations is still in the bootstrap phase.

It requires good leadership, preferably with experience in ramping up global operations and logistics. And that's where the opportunity comes in.

ASOS knows what it is, and it works. It's definition and values are clear, both to the outside world and within the organization. The new CEO doesn't have to "lead the business to a better identity" or anything similar that'll require special expertise in the fashion business.

Finding a CEO that understands logistics, supply chains, and global expansion is easier than finding one with these skills AND fashion experience.

For that reason, I'm less spooked than others that ASOS lost its CEO - in my risk profile, I think it's probable that a new CEO catering to ASOS current needs will be able to push the company to the true global retailer phase.

Mat Dunn got this

Mat Dunn, CFO, and since Beighton resignation COO too, is the responsible adult managing the business until the next CEO will come.

Mat has been with ASOS for almost 3 years now, though his background is in finance and his past companies weren't in the fashion business - he understands ASOS deeply and knows what he's doing.

Watching him in the investors presentation for hours, and in the investors calls, makes it obvious he's in control and knows what's going on in any part of the business.

That is not to say there aren't issues - the supply chain challenge is a big issue. But it is to say that Mat Dunn understand the business and its issues, and I'm confident he'll manage the business in the best way until a new CEO will be appointed.

The online-retail winter

E-commerce has been a pandemic benefactor for obvious reasons. Lockdowns drove almost all consumers to online stores as they were the only available alternative.

Looking at growth rates of several online fashion retailers drive this point perfectly:

2018-2019 represents "normal" growth rates, followed by 2019-2020 crazy growth due to the pandemic, ending with the most recent data of 2020-2021 with the customer base going elsewhere.

Customers spend their money on brick & mortar stores now, on restaurant, travel, whatever they couldn't do during the pandemic.

This reversal in the growth rates sent almost every online retailer stock price into a deep dive. So much so, that some, like ASOS, are priced in multiples that act like its growth days are in the past.

I think this is an over-correction to the ecstatic behavior the market showed while the pandemic growth numbers were out.