Inflation pending?

Inflation has been a trending subject for the past few months of 2021, and it gets all the more heated as we see recent Consumer Price Index measurements that show ~5% rise, along with higher inflation expectations from the Fed.

Whether inflation will go rampant or not is a very complex subject beyond this article. This article assumes you did your own research and got some conclusions on incoming inflation, and you want to know how best to hedge against it.

Determining how much inflation you think is coming and managing this risk is a crucial step. It will decide how much of your portfolio will be devoted to inflation hedges and how you'll pay for "opportunity cost" - for example, whether you should pull out 20% or 100% off of a promising growth company you're invested in.

Assess every individual investment separately

When looking at asset allocation statistically, the details are often hiding behind big numbers. So, for example, a statement like "gold is a great inflation hedge" is factually accurate but might not be right at certain times.

What if everyone already fears inflation, and the media pumped gold as a hedge so much so that gold at this point had a huge run-up that makes it an overprices hedge that will be counter-productive?

Another example might be real estate - it is generally a good vehicle against inflation. But if there's a particular housing crisis in California that got their real estate prices too high already, buying a house there won't be a good investment regardless.

You might be competing with much bigger players than you like most institutional investors are now buying real estate in masses.

Stocks are more volatile with inflation

While we can't say that all stocks suffer from inflation, the data shows more volatility and more downturns for stocks with inflations.

I collected all the data since 1928 about inflation and the S&P 500 (or its equivalent) returns. Here's a visualization of the results:

As inflation rises above 3.5%, we see much more downturns, while times of stable inflation, 1-2%, have much fewer downturns.

This doesn't mean that the stock market will go down with inflation, but it means that there are significantly higher chances of that happening and higher chances for individual stocks to suffer.

The many reasons for stocks loss in inflation

Understanding what is in inflation that harms productive companies is vital for the bigger picture.

Inflation impact different businesses in different ways, and covering it all is impossible. Instead, I'll cover some common cases to give you an idea and a framework of thought when analyzing other companies:

Capital intensive operations

Let's say you have a lemonade stand, and your capital expenditure (in this case, COGS, cost of goods sold) is mostly lemons. In the first year, you buy 1,000$ lemons to produce 1,100$ worth of lemonade that you sell.

That's a 10% margin on regular days. Next year, you can choose to reinvest and expand your business, buying 1,100$ worth of lemons to sell 1,210$ of lemonade.

But in an inflationary environment of 10% a year, the story is different.

You've got 1,100$ after the first year. But since inflation this year was 10%, those 1,100$ buys you the same amount of lemons as 1,000$ used to buy the year before. So inflation ate up all your margins.

This is an oversimplification, but it effectively demonstrates the effect rising prices have on businesses. But, of course, there are caveats - when will you raise the lemonade price, whether you can raise it at all in the face of competition, etc. All affecting the outcome, but the story remains the same.

Money-losing growth companies

Many growth companies today are losing money as a strategy. Often for every 1$ they spend on marketing, bring back a customer that buys for >1$ through the customer's lifetime with the company, making it worthwhile to spend as much as possible now to grab as much of the market earlier.

Inflation will not stop these otherwise great companies, but it will require an adjustment to the growth models.

Marketing platforms and sales processes are getting affected by inflation almost instantaneously. That means that these companies will have to spend more on marketing in an inflationary environment to get the same results.

All while their pricing power is limited. Customers have contracts pre-signed for years often, with limited optionality for price uplifts even when the current contract ends (as these are enterprise contracts for the most part).

Higher expenses to grow, with lower real-value income from all existing recurring customers, will harm the growth of the growth companies. However, they will still grow, albeit slower, and it needs to be accounted for.

I wrote my initial thoughts on this in this Twitter thread:

Why inflation is bad news for SASS, money-losing, but great, growth companies

— Snir David (long term investing) (@snird) June 18, 2021

Super-quick thoughts 🧵$SNOW $MNDY $ASAN $PLTR

Delayed inflation

The last example is delayed inflation, which is somewhat demonstrated in the example above for growth companies.

Sometimes, prices that a company pays to produce their products (including wages) rise before the company can raise their product prices, creating disparity.

Stranded in a long-term agreement with predetermined prices, or a crowd that isn't accustomed to the new price tag, so it avoids the product.

- Furniture company selling to offices in a catalog price for a year, while lumber prices jump 3x on them in the meantime.

- Hairdresser pays higher rent and other living costs, while the crowd prefers to cut their hair at home, as paying 10$ more for a haircut sounds exaggerated to them.

Unproductive assets - Gold, Commodities

Any asset with a limited supply and real-world usage is rising with inflation.

Gold is well known for being a good inflation hedge. It's under limited supply, has underlying value for real-world usage, and has been historically good storage of value, so people trust it.

I collected the prices of gold through time compared to inflation to visualize how this kind of asset if working:

As you can see, gold prices are rising just before inflation increases - as the market always trades on the future, so the action is always slightly before reality.

But it also typically fall right after the highs of inflation. Thus, making timing a crucial step if you want to trade gold. The market always overprices, both in the ups and the downs of unproductive assets.

But over time, gold keeps its value and corrects itself. Thus, making it a good hold against inflation, but a total 0% real return if you hold it for the long-term, and not just temporarily as an inflation hedge.

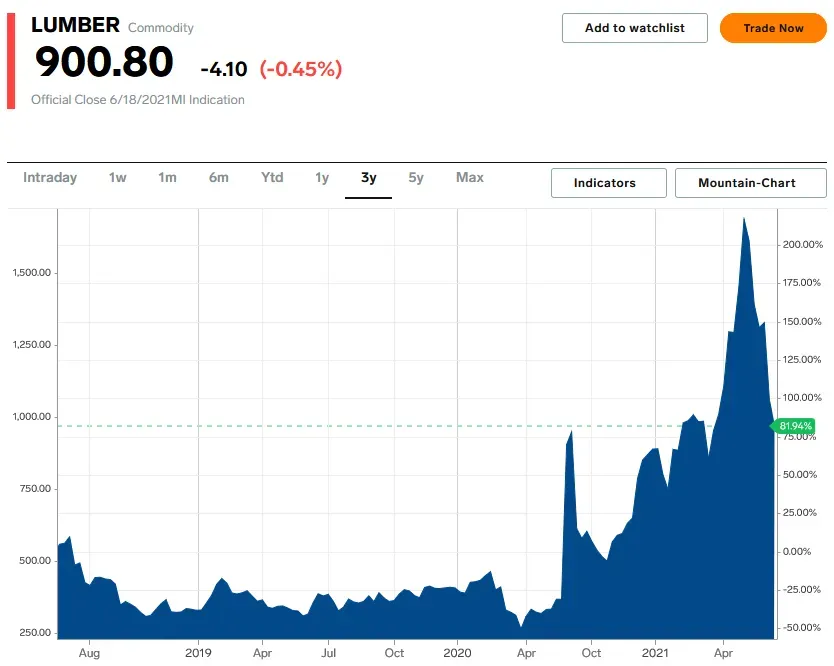

The same story is told for any other commodity. However, right now, we see other craziness in prices of things like lumber and tomato that has more to do with turbulence in the global shipping and production system rather than a reaction to inflation alone.

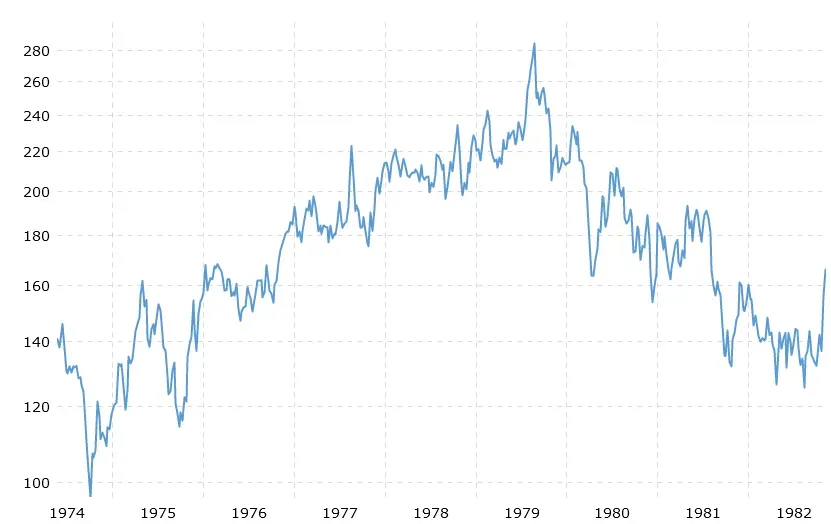

To drive the point forward that commodities are similar to gold, here are the lumber prices in the 1980s inflation spike:

The behavior is very similar to gold. It rises until ~1980 then it drops. While in the long-term, it keeps its underlying value against inflation.

Bitcoin as an unproductive asset?

There is something to be said about Bitcoin, but I'll keep it short, even though I know I'll get a lot of heat for that.

Unproductive assets like gold and commodities are not like Bitcoin for a simple reason: they have intrinsic, underlying value. There are industrial uses for gold and obviously for lumber. Bitcoin doesn't have any use other than its existence.

We can't compare Bitcoin to gold, but it doesn't mean it invalidates Bitcoin as a whole. It just invalidates the usage of Bitcoin as an unproductive asset to hedge against inflation. Whether there are other reasons for Bitcoin to take the world by storm is another discussion.

Real estate and REITs

If we take the lessons from stocks (productive companies) and gold, commodities (unproductive assets), we can see why real estate is considered the best investment for inflation.

- Real estate is productive through rent with minimal capital expenditure. So you will produce more money following inflation without harming the production by the need to put more money in.

- Real estate is limited and real, like gold. Any real asset, as we saw, is rising in price alongside inflation.

Real estate is the best against inflation overall. In the short term, when inflation initially rises, commodities will go higher much faster. But as we saw, they fall back down after. Real estate increases more moderately but doesn't have the fallback later, making it overall more stable and delivering higher returns in the long term.

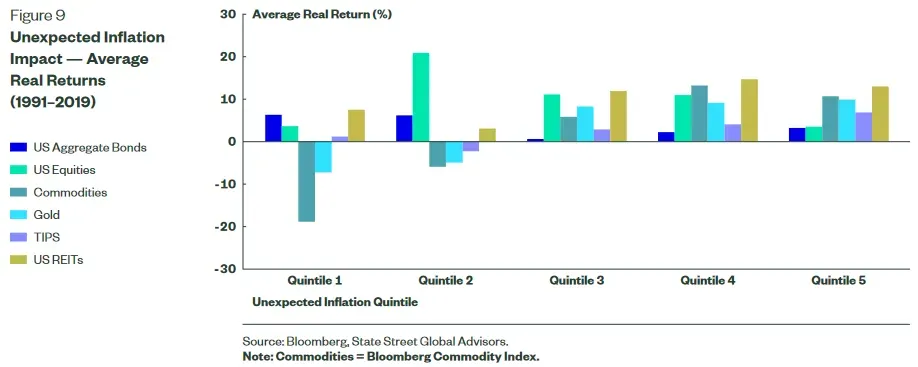

Here's a graph from an excellent research paper from state street that demonstrates the performance of assets in different inflation quantiles (the higher quantile, the higher the inflation).

REITs perform very well in every quantile, making them the best hedge against inflation for the long-term, providing good returns.

P.S - I lied. There is something better than real estate - farms. For the same reasons, just better in every step. But as individual investors, we usually can't buy farms, unlike Bill Gates that went on a massive purchase extravaganza, making him the biggest farmland owner in America.

Other options

There are other options, of course. However, I focused on the most prominent and reasonable ones for individual investors.

Things like TIPS (bonds that follow inflation) naturally protect against inflation, but they come with a 1% coupon these days. Irrelevant. So as government bonds and others, all affected by the extremely low-interest rate, I didn't touch here either.