Strategies to close American Particular card? This info dives deep into the strategy, exploring quite a few methods, potential penalties, and important considerations sooner than taking the plunge. Understanding the nuances of closing your card is critical to managing your funds efficiently and avoiding any unpleasant surprises. From on-line portals to phone calls, and even written requests, we’ll break down each methodology.

We’ll moreover highlight the potential affect in your credit score rating ranking, rewards packages, and additional, empowering you to make an educated decision.

Closing an American Particular card, like a number of financial decision, requires cautious thought. It isn’t merely about cancelling a little bit of plastic; it’s about understanding the ripple outcomes it might have in your normal financial properly being. This whole info offers actionable insights, equipping you with the data to navigate this course of confidently and strategically.

Understanding Closure Selections

Closing an American Particular card may very well be a easy course of, nevertheless understanding the various methods and associated steps is crucial. Realizing your decisions lets you choose the most effective methodology in your desires, whether or not or not you might be trying to find a swift choice or favor a further formal, documented closure. This whole info particulars the completely totally different methods accessible for closing your American Particular account.

Methods for Closing Your American Particular Card

The tactic of closing an American Particular account often entails plenty of decisions. Selecting the best methodology will depend upon personal preferences and desired stage of formality. A clear understanding of each risk empowers educated decision-making.

| Methodology | Description | Required Paperwork |

|---|---|---|

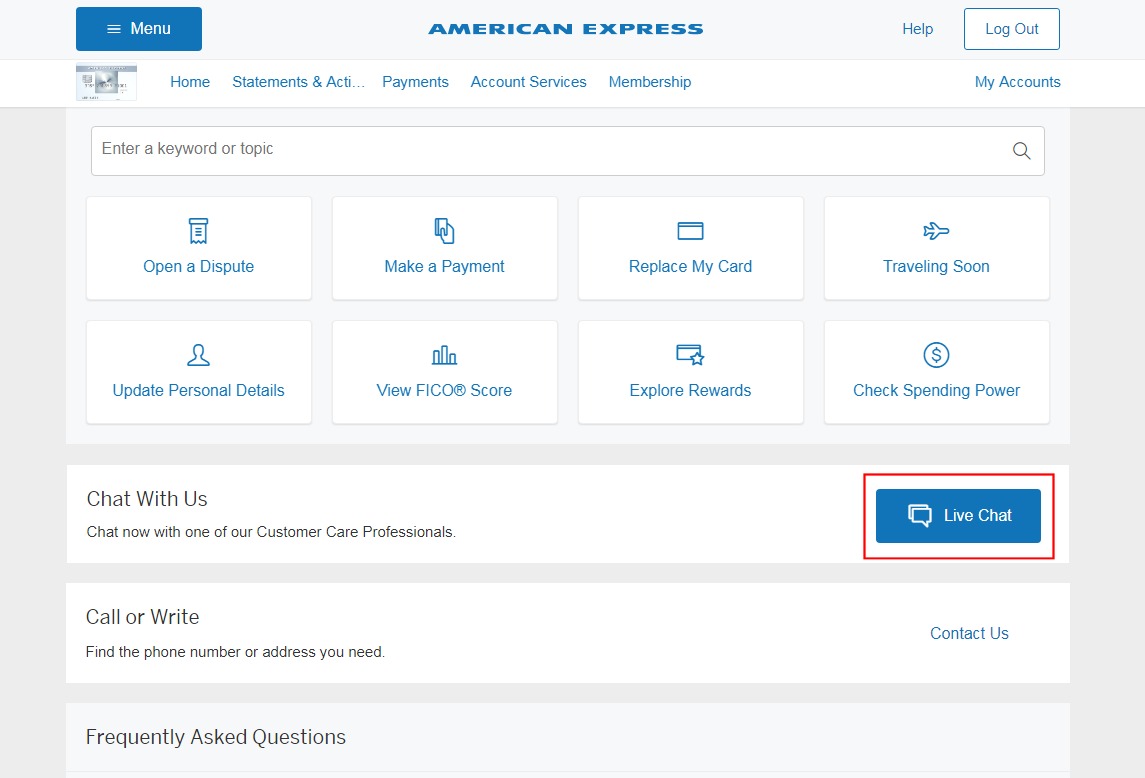

| On-line | Accessing your American Particular account on-line often offers a helpful resolution to impress the closure course of. This technique is generally quick and surroundings pleasant, equipped you’ve got obtained right login credentials. Seek for a loyal “Shut Account” or comparable risk inside your account administration portal. If no on-line risk is obtainable, contact buyer assist. | Account login credentials, in all probability account summary data for verification. |

| By Phone | Contacting American Particular buyer assist immediately by way of phone permits for personalised assist. This technique is helpful for classy circumstances or in case you need clarification on the closure course of. Be prepared to supply account particulars and possibly reply verification questions. | Account amount, title on the account, and possibly a secondary sort of identification. |

| In Writing | A correct written request will probably be submitted to American Particular, although this technique is far much less frequent and often requires a further formal closure course of. This technique often entails a bodily letter addressed to the acceptable division. Be clear and concise in your request, providing all necessary account particulars. | A clearly written letter collectively together with your account amount, title, and deal with, and a replica of a professional image ID. |

Closing vs. Canceling a Card

Whereas the phrases “closing” and “canceling” an American Particular card are generally used interchangeably, there will probably be delicate distinctions. In numerous cases, the phrases are synonymous, which suggests a cessation of account train. Nonetheless, certain eventualities might comprise nuances. Reviewing these potential variations ensures a clear understanding of the implications of each movement.

Steps Involved in Each Closure Methodology

Following the steps associated to each closure methodology ensures a straightforward and surroundings pleasant course of. Detailed steps for each risk are Artikeld underneath.

- On-line Closure: Log in to your American Particular account. Discover the account closure risk. Current necessary data and observe the on-screen instructions. Overview and make sure the closure request. If unsure about any step, contact buyer assist for assist.

- Phone Closure: Dial the American Particular buyer assist amount. Observe the prompts and provide the requested account data. Verify your identification and clearly speak your intention to close the account. Pay money for affirmation of the closure request and doc the date of closure.

- Written Closure: Compose a correct letter to American Particular, collectively together with your account amount, full title, deal with, and a clear assertion of intent to close the account. Ship the letter by way of licensed mail for documentation capabilities. Protect a replica of the letter and the return receipt. Observe up with a phone title to verify the receipt of the letter.

Penalties of Closing an American Particular Card: How To Shut American Particular Card

Closing an American Particular card, whereas seemingly easy, can have important implications in your financial properly being. Understanding these penalties, every constructive and unfavourable, is crucial sooner than making a selection. A hasty closure would possibly inadvertently damage your creditworthiness or limit your entry to helpful rewards packages. Cautious consideration of alternate choices and the potential affect on credit score rating utilization is essential.The selection to close a financial institution card is not going to be a trivial one.

It’s a different with lasting leads to your credit score rating profile and financial approach. Weighing the benefits in direction of the drawbacks, and considering totally different choices, is paramount. This half delves into the various outcomes associated to closing an American Particular card, emphasizing accountable credit score rating administration.

Impression on Credit score rating Score

Credit score rating scores are influenced by quite a few components, and shutting a card can have a noticeable affect. A giant drop in accessible credit score rating can negatively affect your credit score rating utilization ratio, which is a crucial consider credit score rating scoring. Lowering your credit score rating utilization ratio can positively affect your credit score rating ranking.

Lack of Rewards Purposes

Many American Particular taking part in playing cards provide worthwhile rewards packages, along with components, miles, or cash once more. Closing a card means forfeiting these benefits, in all probability hindering your potential to construct up and redeem rewards for journey, merchandise, or totally different desired payments. The shortage of rewards will probably be substantial, notably for a lot of who actively profit from the cardboard for incomes and redeeming rewards.

Impression on Credit score rating Utilization

Credit score rating utilization, the proportion of obtainable credit score rating you might be using, performs an essential perform in credit score rating scoring. Closing a card reduces your accessible credit score rating, in all probability rising your credit score rating utilization ratio. A extreme credit score rating utilization ratio can negatively affect your credit score rating ranking, making it more durable to protected loans, mortgages, or totally different financial merchandise eventually. For instance, closing a card that was used sparingly nevertheless represented a substantial portion of your entire accessible credit score rating can significantly affect this ratio.

Comparability with Alternate choices

As a substitute of closing a card, uncover alternate choices much like transferring balances to a card with greater phrases or decreasing spending on current taking part in playing cards. Transferring balances to a card with a 0% APR promotional interval can stop important curiosity costs, nevertheless this requires cautious planning and adherence to the promotional interval phrases. Accountable spending administration is a key take into consideration sustaining a healthful credit score rating utilization ratio.

Closing a card have to be a remaining resort, considered solely after exhausting all totally different choices.

Conditions The place Closing a Card Might Be Useful, Strategies to close american categorical card

Closing a card could also be a viable risk in case you are no longer using it, if the cardboard has extreme charges of curiosity, or in case you’ve got expert important financial modifications that necessitate a change in financial institution card administration approach. These circumstances warrant cautious consideration and a radical evaluation of the affect in your credit score rating profile. Nonetheless, sooner than closing a card, take into consideration the potential drawbacks and uncover totally different choices.

Parts to Ponder Sooner than Closing a Card

Sooner than closing a card, take into consideration the subsequent components:

- Current credit score rating utilization ratio:

- Accessible credit score rating limit:

- Potential affect on credit score rating ranking:

- Reward packages:

- Charges of curiosity and prices:

- Financial obligations and plans:

Thorough evaluation of these components is essential sooner than making a selection. These considerations are important to understanding the whole ramifications of closing a card.

Needed Issues Sooner than Closing

Understanding the nuances of closing an American Particular card is crucial. It isn’t merely a matter of snapping a change; there are financial implications, potential rewards program penalties, and important particulars buried all through the unbelievable print. Thorough consideration is crucial to creating an educated decision.Closing an American Particular card, whereas seemingly easy, can have important repercussions. It is very important grasp the cardboard’s phrases and circumstances, along with any prices associated to closure.

This accommodates evaluating the potential lack of rewards, the affect in your credit score rating ranking, and any wonderful balances or costs.

Understanding the Card’s Phrases and Conditions

A meticulous analysis of the cardboard’s phrases and circumstances is paramount. These paperwork Artikel the stipulations surrounding closure, along with any associated prices. Failure to know these phrases would possibly lead to sudden costs or penalties. Rigorously scrutinize clauses related to early termination, wonderful balances, and rewards program participation. A clear understanding of these stipulations is critical sooner than persevering with.

Checking for Glorious Balances and Costs

Sooner than initiating the closure course of, meticulously analysis your account assertion for any wonderful balances, pending transactions, or potential prices. This step is essential to stay away from accruing additional debt or penalties. Contact buyer assist if any discrepancies or ambiguities come up.

Constantly Requested Questions Regarding the Closure Course of

This half addresses frequent inquiries regarding the closure course of.

- What happens to my rewards components or miles after I shut my card? Overview the rewards program’s phrases and circumstances to know the implications of closing the cardboard. Some packages might allow for change to a special card, whereas others might forfeit gathered rewards.

- How prolonged does it take for the closure to be processed? Contact American Particular immediately for the exact timeframe, as processing cases can vary counting on specific individual accounts and circumstances.

- Will closing my card affect my credit score rating ranking? Normally, closing a card can have a minor unfavourable affect in your credit score rating ranking. Nonetheless, the severity will depend upon the overall combination of credit score rating accounts and your price historic previous.

- What if I’ve wonderful balances on the cardboard? Paying off the wonderful stability sooner than closing the cardboard could be very advisable to stay away from additional prices or penalties.

Evaluating Execs and Cons of Closing vs. Conserving Open

A comparative analysis highlights the advantages and drawbacks of closing versus conserving an American Particular card open.

| Difficulty | Closing the Card | Conserving the Card Open |

|---|---|---|

| Potential Rewards Loss | Potential lack of gathered rewards, significantly if the rewards program is substantial. | Retention of gathered rewards and the potential to earn further. |

| Credit score rating Score Impression | Potential minor unfavourable affect on credit score rating ranking on account of low cost in credit score rating accounts. | Maintenance of a constructive credit score rating historic previous by conserving an vigorous credit score rating line. |

| Costs | Potential closure prices. | No additional closure prices. |

| Financial Flexibility | Restricted entry to credit score rating line. | Continued entry to the credit score rating line for potential future transactions. |

Implications of Closing a Card with Glorious Rewards Purposes

Closing a card with an vigorous rewards program may end up in an absence of accrued rewards. Utterly analysis the rewards program phrases and circumstances to know the forfeiture protection. In some cases, rewards will probably be transferred to a special American Particular card.

Closing Notes

In conclusion, closing an American Particular card is a significant financial step. This info has equipped an in depth roadmap to understanding the strategy, from the various closure methods to the potential penalties. Consider to fully weigh the professionals and cons, considering your specific individual financial state of affairs and aims. By rigorously considering the steps Artikeld, you might methodology this course of with confidence, guaranteeing a straightforward transition and minimizing any potential unfavourable affect in your credit score rating or rewards packages.

In the long run, making an educated decision is crucial to effectively closing your American Particular card.

Question & Reply Hub

What happens to my rewards components if I shut my card?

Rewards components often each expire or are transferred to a special card, counting on the exact program and phrases. Overview your Amex card settlement for actual particulars.

Can I shut my card if I’ve wonderful stability?

Closing a card with a formidable stability might result in a stability change worth, late prices, or potential damage to your credit score rating report. It’s best to repay any wonderful balances sooner than closing the account.

How prolonged does it take to close an American Particular card?

The closure course of time varies counting on the chosen methodology and Amex’s inside processing. Rely on only a few days to some weeks for the closure to be finalized.

What if I’ve to cancel my card immediately?

Contact Amex immediately by way of phone to request an urgent cancellation. Be prepared to supply the required account particulars.