How having a time horizon of 10+ years serves us to outperform the market.

"What advantage you have as an individual investor over the wall street professional money-managers funds? They do it for a living. You spend a few hours a week/month. Let them manage your money."

The argument for letting other people manage your money through hedge funds or mutual funds is common.

One benefit we usually have on funds is a longer time horizon. The average investor in funds looks at results quarterly, and that's also how most investors pick their funds.

Most funds underperform the market

Many research papers and statistics are showing that most funds fail to beat the market. And that's before considering the management costs people pay for them to underperform.

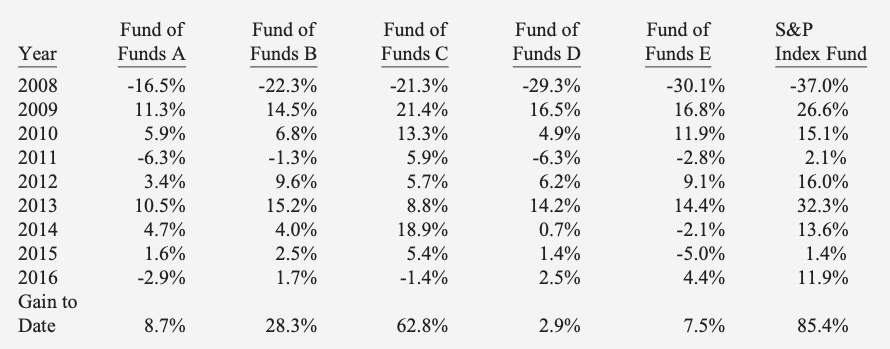

Let's pick a specific example: in 2005, Warren Buffett suggested a bet: He offered 500,000$ for whoever will pick 5 public funds that will beat the passive S&P 500 index over an extended period of time.

Ted Seides took him up on his offer in 2008 and picked 5 top of the line funds of funds.

Buffett won that bet by a large margin. He wrote about it in detail in his 2016 Berkshire Hathaway annual letter, page 22.

This outcome is not uncommon. As you'll dive into this rabbit hole, you'll discover most (some research show >70%) of public hedge funds underperform the market for long periods (more than 5 years usually).

Funds fail due to short time horizon

Investors judge their hedge funds quarterly. Every time the results are out, the knives come out. You can't underperform other peer fund managers for more than 1-2 quarters. Investors will bail quickly.

This short time horizon makes it very difficult to make long-term investments. If you are judged quarterly, you will have to perform at least as well as your peers or the market every quarter.

A quarterly measurement leads to a race for the short-term performers. If a company gets into trouble spanning more than 2 quarters - most funds will bail. They can't hold and enjoy the fruits of their waiting 6+ months from now while showing growing losses in the interim quarter reports.

Funds make money by fees, so they want as many investors in as possible. If investors bail after 1-2 bad quarters compared to peers - revenues will go down, and the fund will have to sell their positions regardless, as the investors take their money with them.

There are solutions, the most famous 2 are:

- Shut down the fund, start a company (mostly insurance) as an investment vehicle. Buffett's Berkshire Hathaway is an example.

- The fund is for invitees only - hedge funds are naturally limited to millionaires that understand the game so that is usually it. This comes with the fund contract changes, usually a clause of "you can take out your money only on one specific day in a year." Li Lu's fund, "Himalaya Capital," is an example.

The first option is viable for you as a retail investor, but you'll have to measure the company and management as any other company. So it's a full circle. You are an active investor again.

The second option is probably not viable for most people (and most readers of this).

You have an edge due to the long time horizon

As an educated individual investor, you can leverage the long time horizon by not having the pressure to show good numbers on paper every quarter.

You can sit in cash

Hedge funds don't have this luxury as investors expect them to "put the money to work."

But you, as an educated investor, can wait for a fantastic opportunity to show itself. And when it will, you'll have the money to go big on it.

An "average" investment that yields 6% per year for 10 years is worth less than one fantastic investment yielding 25% per year for 4 years. Even after accounting for the 6 years of cash as 0%.

10,000$ at 6% per year after 10 years: 17,908$. 10,000$, doing nothing for 6 years then invested in a great company doing 25% per year for 4 years: 24,414$.

It's worth the wait.

You can take the volatility

As an individual investor, you can invest in companies you are convinced have a higher value than they are currently selling for.

The fundamental story you built can be realized over long time periods. Often, years.

These years won't be a straight line. They will be volatile, often having the stock drop 30%, 40%, or even 50%.

As an individual investor - As long as the company's fundamental story hasn't changed, the meaning of this is that you have a great investment you already researched offered at a discount for you. You can buy more! You don't care about "on paper" short-term losses.

For hedge funds - They can't stomach a significant loss that won't correct itself quickly. They'll have to sell the great investment on the first sign of short-term volatility that causes the stock to drop.

You don't have to do anything

Imagine an investor giving 500,000$ for an active hedge fund to find out at the end of the year they did.. nothing.

They had their returns alright. They just didn't buy or sell anything for a year.

Many investors don't like it. They feel like they paid for nothing. So they usually bail, and the circle starts again.

You don't have that kind of pressure - if the right move for a year is to do absolutely nothing, you can do just that.

“The stock market is designed to transfer money from the active to the patient.”

— Snir David (long term investing) (@snird) November 26, 2020

- Warren Buffett

In conclusion

I'm a great believer in playing to your strengths. Long time horizon is one fundamental strength we have over professional hedge funds and probably over many individual investors that aren't aware of that.

Use it.

Long time horizon is a superpower we have as retail investors.

— Snir David (long term investing) (@snird) November 25, 2020

We don't have to worry about temporary market fluctuations and events.

We can focus on the bigger picture.

Asking "will this company be great 5 years from now?" and nothing more.