Twitter underperformed the last few years, and as a result, has been unloved in the markets. And justifiably so, to mention some hiccups:

- Inconsistent revenue growth.

- Lagging performance of other companies in the field - the ARPU (average revenue per user) is far behind competitors like Facebook.

- Untapped unique opportunities to monetize their social network like no other can.

- Missing market opportunities (it seems like every social network benefitted from the Covid events, but Twitter).

- Management that seems oblivious (Jack cares more about Square).

- Destroying fantastic opportunities (Vine should have been TikTok, Periscope should have been much larger).

- And more.

All of these combined pushed Twitter's price down, and for a good reason. But I claim the price is too low for the opportunities Twitter has. With a strong networking moat and even stronger position as the best "text-based" social platform, combined with the recent velocity of product enhancements, the upside significantly outweighs the downside.

The current velocity in the product is visible - with Revue's purchase for a new monetization path, launch of "fleets" feature, and launch of "spaces". I'm also hopeful that the current monetization of users through ads will get much better.

This opportunity became too clear for me three months ago when I reported I'm taking a position in Twitter:

I'm taking up a position on $TWTR.

— Snir David (long term investing) (@snird) November 2, 2020

First public position for me, it'll either look really good or really bad in 3 years.

This is my thesis in a thread 🧵

I bought at the bottom at 39$ a stock by pure luck, locking >70% rise since. Even yet, I believe the company is still a great opportunity at ~69$.

Business overview

Twitter is a social network based on the "follow" model (like Instagram, Snapchat) instead of the friends model, like Facebook that is two-sided.

Twitter is a text-leaning platform, even though videos and images are available there. Being text-leaning attracts discussion and information-leaning users to the platform - news and info "cliques" such as investing (that I'm personally a part of), programmers, music producers, and many more I won't even pretend I understand.

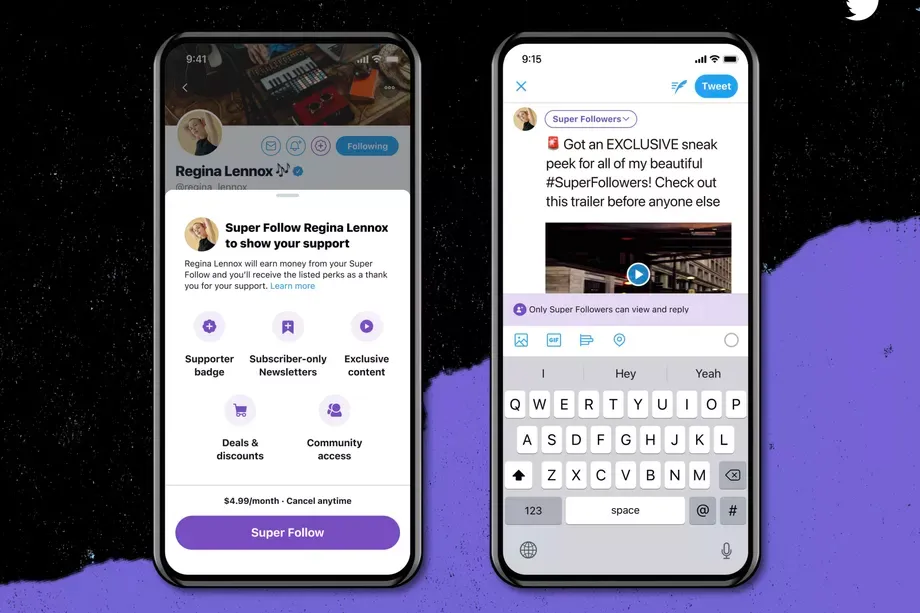

This unique position among knowledge communities ties to the new business opportunities Twitter has with features like the new "Super follow" coming directly from Revue's purchase.

Current revenue drivers

Most of Twitter's revenues come from advertising, with a small part of the revenues coming from data licensing.

These are the revenues of Twitter from the past two years by quarter divided to the business to visualize it:

This revenue split & trend tells us:

- Advertising is the primary revenue driver

- Data licensing isn't growing and is a tiny portion of revenues

- Twitter struggles to push revenues the past few years

- The last quarter was extraordinary compares with any quarter of the past three years. Explaining the recent stock rise.

Even though Twitter had superior growth in revenues in the last quarter, it still had a weak few years, and even with the last quarter, it underperformed its peers significantly.

Other social media competitors leveraged the Covid situation and stay-at-home orders to make significant revenue growth, whereas Twitter mostly flopped. It's apparent when we look at the revenues uplift in percentage from 2019 Q4 to the recent 2020 Q4.

Advertising revenues future

There are two drivers to its growth of advertising revenues: The number of users watching the ads and the average revenue per user (ARPU). Both have massive growth potential within Twitter.

ARPU

Twitter does not publish an ARPU number outright as Facebook does, for example, but it can be estimated given the number of active users and published revenues. And estimation is all we need.

Let's compare Twitter with the market leader in monetization - Facebook:

- Twitter - ~16$ ARPU

- Facebook - 32$ ARPU

Twitter is at ~50% of the ARPU power that Facebook has. To be realistic, I don't think Twitter will ever get or will be able to get to Facebook's monetization power.

But an uplift is undoubtedly possible - especially given the fact that every Twitter user knows how bad their ads are. We are in the world of rough estimates, so I estimate a 25% uplift is possible within the next few years.

That's 25% more revenues possible without growing the number of users in the platform. And it will grow.

Users

The primary metric Twitter uses for users is mDAU - monetizable daily active users. The "monetizable" part is due to many bots or other kinds of accounts in the platform that aren't monetizable.

The mDAU metric is presented in reports as a quarterly average. Moreover, in the past, Twitter presented monthly user data and not daily, making it harder to estimate ARPU (above) and comparing DAU data to past MAU data.

The mDAU growth is consistent and steady. Yet, the revenues didn't grow as consistently. That is mostly due to different users coming to the platform (a USA-based user is worth much more than a European one worth much more than a Middle Eastern one) and fluctuations in the ads system's effectiveness.

Excluding the last quarter that was phenomenal in revenue growth, we had 71.6% mDau growth since 2017 with 70.8% growth in revenues for the same period. So you can see why the markets were concerned - no advancement in monetization. Including the last quarter, we have 76.1% mDAU growth with 135.2% revenue growth since 2017. You can see why the markets have been excited about Twitter recently.

New monetization paths - creator's economy

While the advertising revenues can grow significantly, both by bringing more users to the platform and monetizing them better - Twitter is uniquely posed to monetize the creator's economy, and they are finally acting on it.

I invested 3 months ago on a thesis they will get into it sooner or later, and sooner turned out to be the answer. The "super follow" feature is the first glimpse.

In short, super-follow allows people to pay a small subscription fee for a creator they like to get access to exclusive content he creates for them.

The potential for this is crazy. In the last few years, the creator's economy boomed in every area possible - from journalists and writers starting their paid newsletter on platforms like Substack through adult content in Onlyfans and artists publishing their work on Patreon. Twitter now provides a solution to all.

Twitter has the advantage of being the place where people can discover creators. Having many communities on Twitter, the good ones naturally rise through community talk and algorithm discovery.

Already many creators use Twitter to get discovered and move their greatest fans to Substack, Patreon, Only Fans, and many other platforms. What is more natural than keeping your loyal audience in the discovery platform rather than have them moving to another platform?

This model is already implemented in Youtube members. Youtube is the discovery platform for video creators, so the monetization for premium content will be there naturally. Twitter is like Youtube in that sense, for creators focusing on text and somewhat images (Instagram can do the same for image content. Leaving Twitter with its natural text strength alone.)

Moreover, I can identify a potential flywheel effect here. As creators will move their paid content to Twitter, it will drive more users to consume that content, which will drive more creators to Twitter.

Income estimation from creators

This is where the bullshit usually comes. I can't project this to the future, and no one else can do it reliably too. There are too many variables to come up with a reliable estimate at this point.

Every way I tried to estimate this looked like nonsense to me a few hours later. For example, what if Taylor Swift, with her >80M followers, decides to start a paid subscription for 5$ a month?

In this case, it's safe to assume >20M in sales just for her (she will drive many more people to the platform), which is 100M$ every month, at a 10% cut for the platform -that's 10M$ more in revenues. 30M$ in a quarter. Almost 3% uplift from this one creator.

The super-follow feature has so much potential for black-swan events like this that any estimate will be merely a guess.

I can utilize a reasonable growth adjustment to the revenues given the high-revenue potential, Twitter's unique position as a discovery platform, and the fact that we already know that premium creator's content is a thing through competitors. I will follow up on this on the valuation part.

Management

The bear case for Twitter's management is strong. An inexhaustive list includes:

- Stagnating revenue growth for years.

- Missing the Covid opportunity.

- The platform's lack of innovation for years.

- The destruction of epic opportunities like Vine and Periscope should be taught in every MBA as the best way to destroy good businesses.

As for personnel, Jack is the CEO of both Twitter and Square, and it seems like he doesn't care about Twitter. And when he does talk about Twitter, like in hearings, we all pray he didn't.

But I'm here to claim that the past is in the past. The recent performance of Twitter proves that something has changed.

They have much higher product velocity. In the past year, Twitter released fleets, spaces, and super-follow. Fleets are a re-attribution of the stories features from competitors, spaces are a new sound-based interactions system, and super-follow is a new monetization program.

A good indicator of the change for me is how they acted upon the "spaces" opportunity. With the new hype around sound-based platforms such as Clubhouse - Twitter released their Spaces feature on time and even made it available to Android users before Clubhouse.

A big "corporation" like Twitter, with all the complexities of its existing platform and scale, was able to ship a product faster than a lean startup without prior commitments and top VC dollars. Think about it.

I can't point out what has changed within Twitter in the last year, at least not from what is revealed publicly, but I'd say I have confidence in the current management.

In Twitter's case, the fact that they performed lately and delivered interesting product developments will be a further driving force to attract great talent to the company. If there is something talented engineers like, it's to work among other gifted engineers.

Moat - The network effect enhanced

Twitter has the classic network effect working in its favor. People want to go wherever everyone else already is, so it is a positive feedback loop for Twitter.

The same effect works for many other businesses. Facebook would be a ghost town if you didn't have all your friends and communities there. Google+ proved that much.

We also know that a network moat is a deep moat - incremental improvements in a product can't overcome the network. That's why WhatsApp is still dominant even though it is consistently very, very late to innovate and take features from competitors. To overcome the network moat, you need to be absolutely disruptive. Incremental improvements won't do (considering the moated company doesn't do anything spectacularly stupid like the WhatsApp privacy debacle).

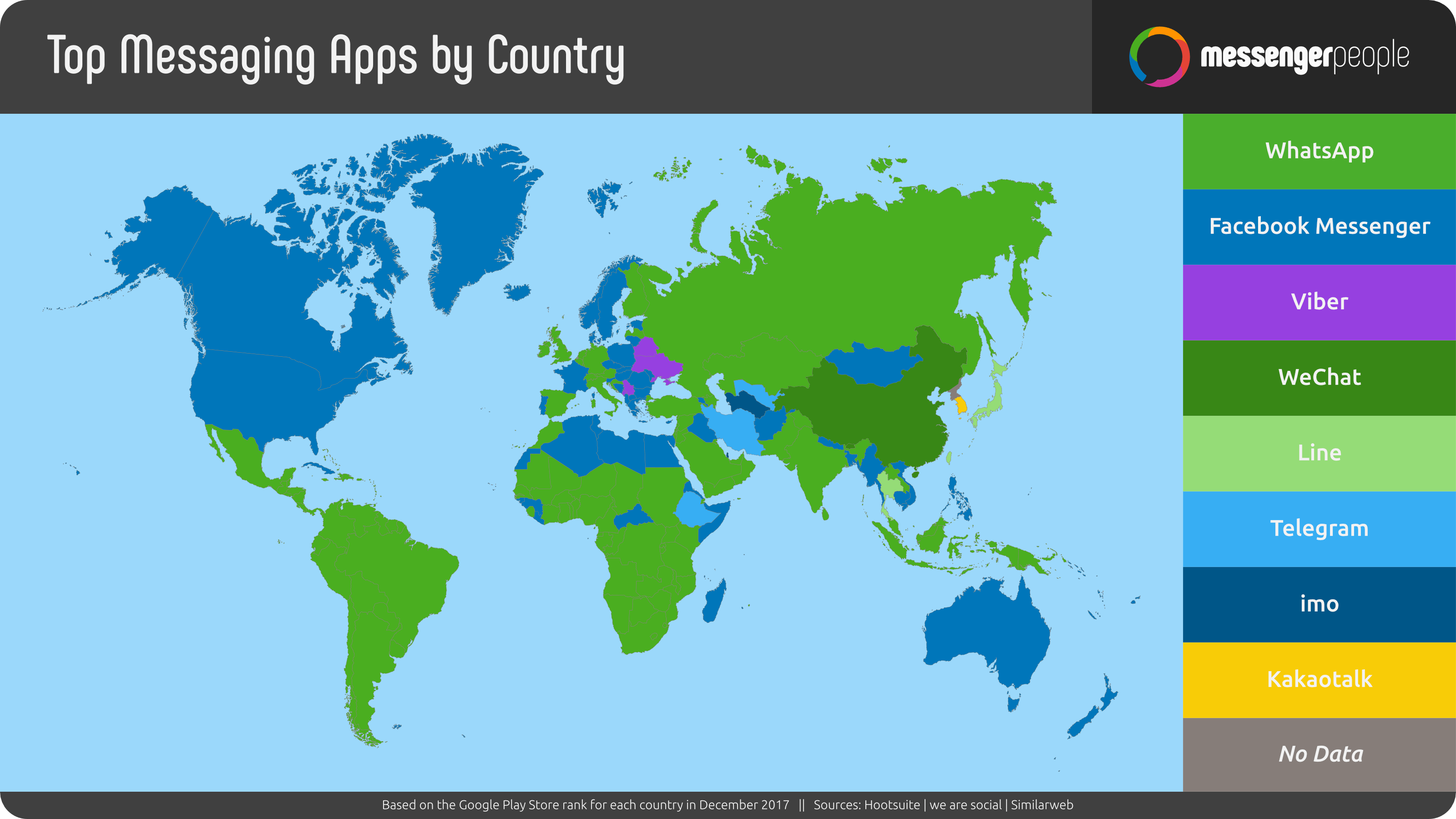

I'm claiming that Twitter has a super-network moat that other social networks like Facebook, Instagram, WhatsApp, Snap, and others are missing.

All these networks are reliant on the local-first communities. That's why WhatsApp is prominent in some countries, FB messenger in others, and Viber (??) in others:

Messenger Apss Map - by 'messengerpeople.com'

If your friends are not on Facebook, Instagram, or Snap to begin with - you have nothing to do with the app.

Twitter isn't dependant on your local community. Its behavior is similar to TikTok in that sense - you can get in and find your interests regardless of your community.

It also allows you to discuss any subject regardless of your previous inclinations. The TikTok algorithm bounds you to specific content. With Twitter, I can discuss investing all the time but jump into #AbolishTheMonarchy quickly if I want to.

The ability to form "mini-communities" aside from your "regular" everyday community on Twitter makes its network effect much more robust.

I don't want to join a Facebook group of "British Royal Discussions" or anything like that. How would I even find it? But I can see what people think about the current news through the trending #AbolishTheMonarchy hashtag.

Valuation

Valuing Twitter is a difficult task. Twitter's biggest asset is its people network, and the potential of additional businesses on this network is enormous.

The potential is hard to estimate, but with my defensive approach, I'd like to look at the recent performance of Twitter in an attempt to understand what a "solid" growth without additional business models might look like.

Then, take this "safe" growth as the baseline with most chances of happening - limit my downside in case Twitter will manage to blow up the creator's market opportunity, the Spaces opportunity, or any other opportunity coming up.

For growth estimation, I focused on two metrics. First is EBITDA:

Second is Owner's Cash Flows (adjusted owners earning method from Buffett):

These two graphs on their own tell us almost nothing.

It seems like 2018 was a hit, and then Twitter slowly declined. But the reality is more nuanced.

Looking at the EBITDA quarterly data, we can see Q4 of 2018 was an outlier, responsible for this year's good look compared to others. Since then, the trend down is due to somewhat lower revenues but more so due to higher operations costs.

- R&D costs went from 150M$ in Q4'18 to 208M$ in Q3'20.

- SG&A costs went from 292M$ in Q4'18 to 309M$ in Q3'20.

- Other expenses went from 433$ in Q4'18 to 519$ in Q3'20.

The rising costs are not consistent. It's almost across every type of cost that Twitter had the lowest point since 2015 in each - which, alongside somewhat better earnings, created a "perfect storm."

We can say a similar thing about 2020, where Q2 took a huge loss due to Covid.

Without the Covid hit and with consistent costs management, we could expect consistent ~20% growth every year. I'll use 15% growth as the expected baseline (leaving 5% on the table as a margin of safety of my estimation) for the next 5 years.

For the bull case, I'll use 20% growth over the next 5 years, and for the bear case 5% growth. As for terminal values, I will use the same growth metrics on revenues (of $3.7B at the time of writing) and terminal P/S of 10, which Twitter revolved around most of the time (even though writing it, the P/S ratio is at 18).

The DCF models are here and available for your adjustments if you have different ideas:

As you can see from my valuation, at a discount rate of 12%, Twitter was on the purchase price a few months ago (when I bought it), but it still isn't too far away now - especially if you lower the discount rate.