Seritage Growth Properties ($SRG) has been a value-community darling for over a year. Started with Mohnish Pabrai buying into the opportunity, so much so that he's now the most significant owner at 10.85% of the shared, followed by other super-investors funds like Guy Spier's Aquamarine and Hotchkis.

I first looked at Seritage in March 2021, but the company was too hard to understand with too many question marks, so it went into my "too-hard" pile. But a management shift, with new CEO Andrea Olshan, changed that. Soon after Andrea came into Seritage, she re-examined and re-organized all the company assets and made them easier to understand and more transparent for the investors.

Furthermore, recent changes in the debt story pushed me from "it might be a value trap" to "this is a crazy opportunity, and I'm so lucky the price hadn't caught up yet".

Seritage $SRG paid $160M for their debt, which will lower interest rate payments by $11M annually.

— Snir David (long term investing) (@snird) January 5, 2022

This makes the investment a no-brainer for me now. It lowers the ceiling to get cash-flow positive from rent and has long-term effect on cash flows in general.

I just loaded $SRG

In this deep dive I examine the turnover story, and why I think Seritage can turn >100% gain in price within the next 2 years.

Business overview

Seritage is a REIT founded in 2015 as a spin-off from Sears holdings - $2.7B of real-estate assets purchased from Sears with ~$700M of funding coming from common shares and ~$2B from a Berkshire Hathaway term-loan.

As a spin-off, most of the assets were rented to Sears (and other related brands like K-mart). The plan was to gradually move away from this dependence on Sears by redeveloping assets to accommodate other tenants and diversify the tenant portfolio.

Sears declared bankruptcy in mid-2018, leading to a much faster weigh-down in rent from Sears - way before Seritage was ready for it. This led to a fast decline in rent revenues, as the assets couldn't be developed quickly enough and there were no alternative renters with needs similar to those of Sears in terms of the real-estate structure.

Then, as rental income already going down, COVID hits and intensified the rental income loss pace. We can see how rental income slowly goes down since mid-2018 and then all at once in 2020:

Business models

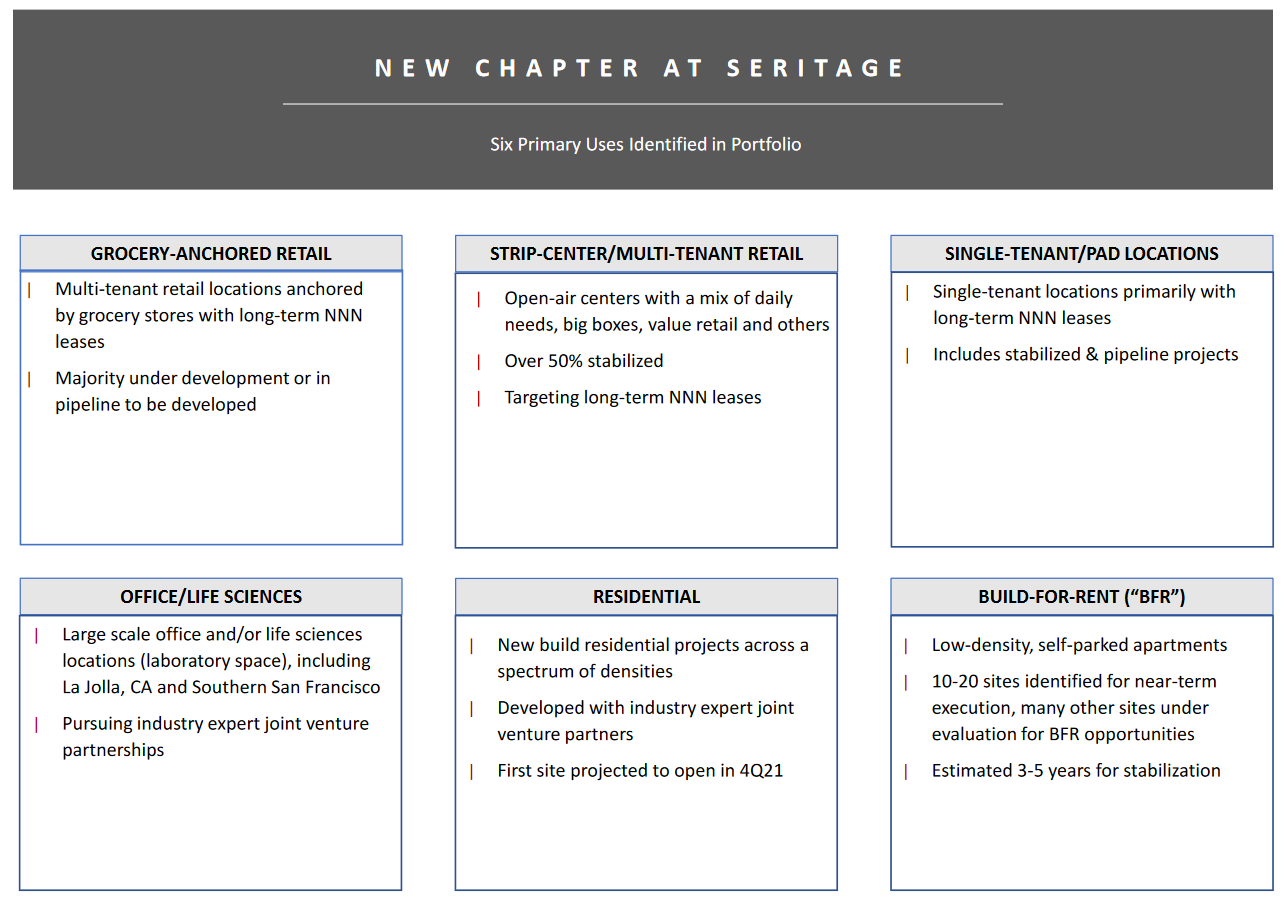

After Andrea Olshan took the position as CEO in Feb-2021, she announced a reorganization of Seritage portfolio, based on 6 business models:

Grocery-anchored retail, Multi-tenant retail, Single-tenant (NNN) retail, Offices / Life science, Residential, Built for rent

There are 3 major benefits to the portfolio reorganization:

- Focus on what Seritage can do best. It means, that assets that can't fit in these categories will be sold out. This will lead to a more organized assets disposition rather than the sporadic, semi-random disposition that happened before.

- Clear expectations from redeveloped assets. Each business model has a typical development cycle and typical rent range. This gives more clarity on the portfolio expectations.

- Connected to point 2, having expectations easier to assess - will eventually lead to more accessible institutional debt.

The last point is a direct target for this that Andrea Olshan mentioned in the recent Nareit presentation and interview she gave. I summarized the entire interview if you want to go deeper:

My notes from @AndreaOlshan interview at the Annual @REITs_Nareit conf.

— Snir David (long term investing) (@snird) December 24, 2021

About $SRG opportunities

including timestamps pic.twitter.com/4BpQ4gKDuD

This point is crucial and leads us directly to the second subject:

Seritage debt

What weigh down Seritage and presents most of the risk is their massive debt owed to Berkshire-Hathaway. Originally $2B with maturity in July 2023, some facts have changed and are relevant to the recent story:

- $160M of the principal was paid last week, lowering annual interest payments by $11M.

- A recent agreement extends the loan to July 2025 given that the principal remaining by then will be $800M.

- $1.44B remaining with a 7% interest.

- $400M with 1% interest available given some goals achieved - the goals won't be achieved for years.

- Berkshire Hathaway has approval rights for all assets sales.

- The agreement states that in case the Seritage can't pay at any point, the interest payments can be deferred.

This is a very expensive debt that grants Berkshire-Hathaway some administrative control and its due date isn't too far away, although the agreement to kick down part of the can to 2025 gives some more room to breathe.

This debt and the interest on it are so heavy, that for years now Seritage was only able to pay up the interest alone with no part of the principal. Here is a comparison between rental income and interest rate payments in the past 3 years:

If before 2020, Covid hit Seritage at least earned Significantly more than their interest expenses, after Covid, Seritage is barely earning enough from the rent to cover their interest costs.

And that's before real estate taxes, operations, and management expenses that move Seritage deep into the loss teritory.

The upside is that with the recent $160M principal payment, the average ~$26M in interest per quarter will be lowered to ~$23M.

The opportunity to come back

Seritage is bleeding money paying its debt interest, management overhead, and financing redevelopment projects to make its assets viable. It stays afloat by selling undesirable assets for cash flow.

The NAV (net assets value) of Seritage is well above its trading price, the price is low to reflect the risk of default or simply fire-selling many assets below their value to serve the ongoing bills.

That's why I focus on the path to profitability rather than NAV calculations to turn around in a snowball effect:

- Seritage needs to add ~$30M in quarterly rent collection to come close enough to be profitable. (After taking into account a slightly lower interest payments post-$160M principal payment).

- Once they'll get close enough, and with good future prospects, it'll be possible to recycle a significant amount of the debt for far better terms.

- A ~3.5%-4% interest for a recycled debt, for what will now be a profitable enterprise, is more than reasonable. But I calculated assuming 4.5%, to get a little margin. Which will lower interest payment by $10M quarterly - explaining the ~$30M in step 1, even though they currently lose ~$40M quarterly. (Andrea Olshan mentioned expectation for 3.5% recycle in one interview)

- Cash flow positivity will allow for more redevelopment financing without disposing of other assets in a rush - even better prospects and higher tangible value of assets they wouldn't have to sell "right now".

If this story pans out, Seritage can jump back in value to what it had pre-COVID which was ~$40, representing a ~185% price hike from the current price of ~14$. I like seeing these numbers - because even if I'm way off and it will only go to ~30$ that's still ~115% gain. And on the side of the price, we have many beneficial tailwinds, like inflation in general and real-estate inflation in particular.

Technically, they have until July 2025, the term-loan end date, to get there (or the payment will crush the business that'll probably have to loan again in worse terms).

Upcoming revenue streams

The journey for ~$30M in quarterly income goes through 3 main paths: SNO agreements, Redevelopment projects, and Lease of currently vacant space.

SNO

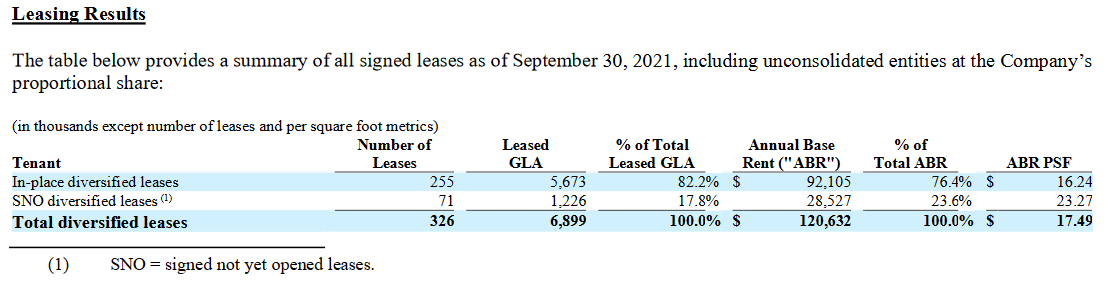

SNO - Signed not yet opened, are the reported income from agreements already signed. This is the most important and "stable" indicator of all the upcoming revenue streams.

According to their latest report, there are $28.5M in annual SNO for a GLA of 1.225M sqft, which translates to $7.1M in quarterly income. That's a good start.

The SNO agreements are mostly for redevelopment projects already in their final phases, such as the multi-tenant retail projects in Roseville, Calif., and Ft. Wayne that had >90% of GLA leased under the SNO.

Some parts of the SNO are for rental space that is vacant regardless of redevelopments.

Current flow: $30M - $7.1M = $22.9M

Soon-to-be-done redevelopments

Park Heritage, Dallas

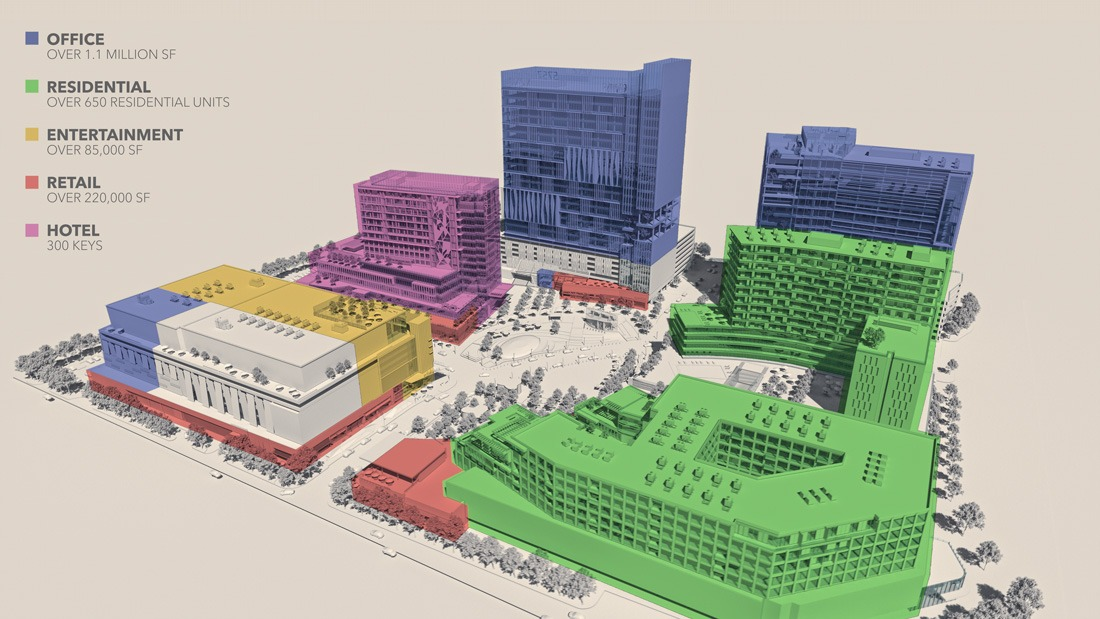

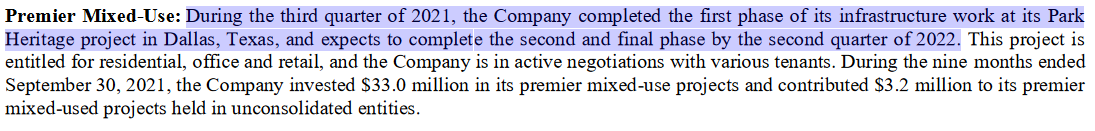

Park Heritage in Dallas is maybe the biggest redevelopment project of Seritage at the moment. Offering a Premier Mixed-Use space of offices, residential, entertainment, retail, and hotel in one place.

The project will finish its infrastructure phase by mid-2022, so by the typical building time it's reasonable to expect some properties to operate by end of 2023 and all by 2024.

Rental income assessment:

- Office - The average price per sqft of office in Dallas is $30.36 meaning for 1.1M sqft the potential is $33.3M

- Retail & Entertainment - For premier projects like this, the lowest estimate for price per sqft is $40, though expected to be much higher. So for 305,000 sqft, the potential is $12.2M

- Hotel - In similar hotels in the area (I checked 10 hotels with public info and 10 private ones by looking at prices) it's ~$140 average rate. The average occupancy is 65%. This means ~$10M in income annually.

- Residential - 650 units, unclear how many are for sale and how many are for rent. So I'll take the absolute reasonable minimum of $8M in annual income from this huge residential complex.

This all sums up to $63.5M in annual income.

I'll take 20% off of that to be extra safe and to account for property management and maintenance. Which leaves us with ~$51M annually, or ~$12.7M every quarter. And that's with a great margin of safety both on the 20% off I took and in the estimated prices I took, as this project is expected to get above-average prices in everything.

Current flow: $30M - $7.1M - $12.7M = $10.2M

The collection, UTC La Jolla California

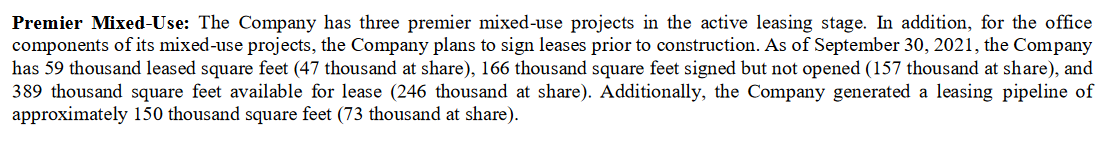

The collection is another premier mixed-use location. The latest data in the Q3 report mentions 20% of the space leased/SNO. But a more recent PR announcement mentions 88% leased/under negotiation.

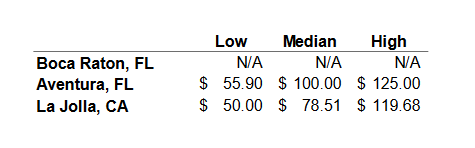

That means an additional 70,000 sqft for rent, most of it already signed. We don't need to do much price guessing, as Seritage provided it in a presentation in the NAREIT conference:

Going with the median ~$75 for 70,000 sqft is $5.3M. Shaving 15% off for management and an extra margin of safety leaves $4.5M annually, or $1.1M quarterly.

Current flow: $30M - $7.1M - $12.7M - $1.1M = $9.1M

Esplande, Aventura Miami

The Esplanade project (video showcase) had its fair share of troubles following the Covid lockdowns but is now on track for completion by the end of 2022.

51% of the space is already leased and marked under SNO, leaving a 100,000 sqft of retail space to be leased. As shown above, the median price per sqft is 100$.

This means an additional $10M a year, or $2.5M every quarter, taking 15% off the top and we're left with $2.1M every quarter.

Current flow: $30M - $7.1M - $12M - $1.1M - $2.1M = $7M

Unleased retail space

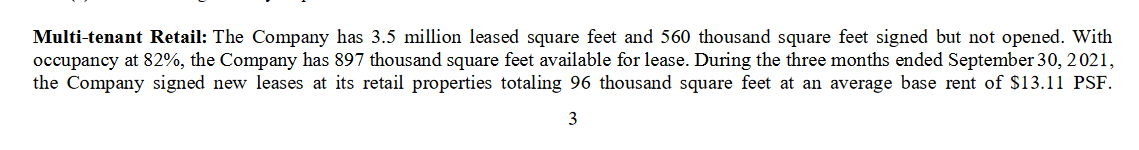

There is a huge amount of unleashed retail space available to Seritage:

- 897,000 sqft of multi-tenant space

- 389,000 sqft of premier mixed-use

Each has different expected average base rent per sqft. For the retail, it ranges from $10-$13, while for the premier it ranges from $20-$23.

If we play the super-optimistic game, the untapped income is:

- retail: 897,000 * ~10-13 = ~$9M-$11.5M annually -> ~$2.25M-$2.8M quarterly

- premier: 389,000 * ~20-23 = ~$7.8M-$9M annually -> ~$1.95M-$2.25M quarterly

So it's $4M-$5M in quarterly income for ready, not yet leased space in multi-tenant retail and premier mixed-use retail space. I say ready because Seritage doesn't classify undeveloped space under these definitions.

If we'll take a margin of safety again, this time a bigger one since it's unreasonable to expect 100% occupancy, I'll mark it as an additional $2M quarterly that will probably be tapped into by the end of 2023.

Current flow: $30M - $7.1M - $12M - $1.1M - $2.1M - $2M = $5M

Other developments

We're still $5M short of the target, though, in a "lucky" scenario, in which my margins of safety were too hefty, all the projects described above should be enough by themselves.

But I'm not worried this gap will be filled before the debt maturity if not already filled and I just can't figure it out:

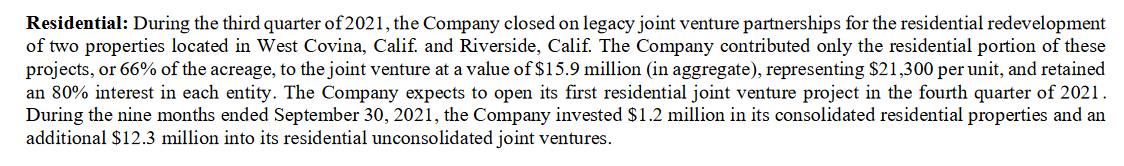

There are more development projects going on than mentioned here. For example, 2 residential projects mentioned in the last quarterly report but have no additional data anywhere and the language is too cryptic to estimate their worth.

More than that, the list appearing in the reports is not exhaustive. The last quarterly report was the first to orderly mention most of them. There could be more redevelopment projects already in progress that I just don't know about.

One example is the Boca Raton project that originally had legal difficulties when it should have started in 2018. But it was implied in interviews and presentations that this project is getting ready to kickstart again. If that happens, this project alone pushes us way beyond an additional $5.7M in quarterly income.

And even if that's wrong, there are so many other properties to redevelop with projects that take 18-24 months. So with the "deadline" of end-2023, there is so much time it's unreasonable to assume no further redevelopment projects will take place.

Management

A word about management - it's changing. With the big change in CEO to Andrea Olshan, slowly the entire management team is being replaced. Even as I write this, Seritage appointed an interim CFO.

Change of management is always scary, especially when the entire management team is slowly changing. But in this case, I think I trust Andrea Olshan.

Andrea Olshan was CEO of Olshan Properties. Leaving the family business to find success in the public world is a hard decision, and one I personally think will push her to do it well.

The work she's done on organizing assets and increasing transparency in Seritage already gives me a lot of trust in her management. Olshan also has her share of experience in shady-legal-actions, so if anything I trust she can stomach hard turbulence and navigate the ship.

Summary

Seritage got 2 consecutive massive hits: Sears bankruptcy in 2018 leaving most of its assets vacant, and then Covid in 2020 that pushed away development projects and made many residents leave.

These hits drove Seritage price way down, into the deep value territory as it presented a real risk for defaulting or at least of becoming a zombie company.

But the redevelopment projects and the prospects of its assets make me confident that Seritage will go out of the rut, and with it get its price fixed up to a point that can present over 100% return within 2 years.

Update

Following great comments by some readers, I posted an update with things I overlooked in this Seritage deep dive.