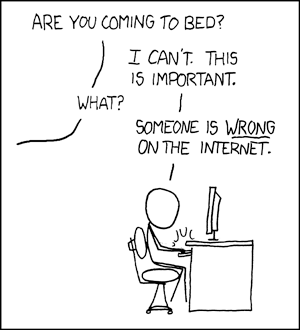

They say that if you want to get the right answer, just post the wrong answer on the internet and someone will correct you.

Yesterday I published my deep-dive into Seritage, and the caught the attention of enough talented people that sent me additional references or pointed things that I missed. I want to go through them. Thanks to @thepupil11 and @investingdpark for some of the materials.

Timelines

The first very important semi-neglected point in my deep-dive is project timelines. I talked about the path to profitability that is very dependant on redevelopment projects, but some of them are still too far away.

Premier locations

The premier locations are the most ambitious projects of Seritage, each of them will be worth close to a billion dollars upon completion - eventually storing most of the value for Seritage. But those projects take more time to develop, naturally.

The primary one is the flagship project in Dallas - Park Heritage. It will be done with the infrastructure phase by mid-2022. That means that if the building phase is starting right after, it can still take 1.5-2.5 years for completion and cash flow.

The Boca Raton project mentioned later is still in an unclear state due to its legal difficulties since 2018. Although, as I mentioned, in some interviews it sounded like this was resolved. But even if it is - we're a few years away from seeing this massive project completed.

Multi-tenant retails

The other, less ambitious category for Seritage is the Multi-tenant retail that already has been proven to be a "quick" (relatively) development for upgraded income.

The timelines here are typically simpler, with 18 months for redevelopment. So at that thing, my deep-dive conclusions remain as they are. Yet, the income from these projects is not as luxurious as the premier locations - so It'll take many more such developments to get to a significant income upgrade.

Financing

To redevelop, you need money. This is exacerbated given that the timeline is a few years, as suggested in the point above - because you also need to cover interest, taxes, and management in that time.

I neglected to address this part in detail, merely handwavingly saying that Seritage sells some of its assets to finance its ongoing operations and redevelopment. And that this sale process is now more intentional since Andrea Olshan reorganized the properties and created the big plan forward.

But, if we take the Dallas Park Heritage project as the main example again, by some rough estimates it'll take $500M-$600M to build.

The current annual income from assets sale is ~$280M. And a lot of it goes to paying the bills - not enough of it is left to finance such a massive project.

Seritage will either have to ramp up the disposition of their assets, or they'll have to find financing through investors. So it's not a smooth sail on the same rhythm all the way to profitability - something has to change.

Which is WEIRD. Because as I mentioned yesterday, Seritage just paid $160M for its debt. Which is one of the indicators that led me to trust them more. But if they might be cash stranded for the redevelopments - why make a down payment for the debt?

From here it's only speculations - maybe because they want investors to trust them for the coming financing action, so they wanted to show a movement in the debt segment. Also, the CFO quit at roughly the same time - was that because of an internal disagreement about this action?

Valuation

In the original, I said that the price I expect Seritage to go to is at least what it was pre-COVID. Which is not much of a valuation or reasoning.

I agree. It isn't. The valuation action should be done through either NAV, FFO multiples, Cap rate, or any other streamlines method for real estate.

The thing is, once the default risk is out - all these valuations will be valid. And many before me already did this work, all landed in the $30-$45. Brad Kaellner is a great example of someone who does this valuation continuously.

Does the story change?

For now, at least, my trust is a bit down. From "a crazy opportunity" it's down to "if we're lucky and the stars align - this is a great opportunity".

The price of Seritage is so low, that even if in the next few quarters we'll discover timeline and financing issues - the potential loss in face of full assets liquidation is limited. But the potential massive win remains. I still look at Seritage as an imbalanced risk-opportunity case.