In my Twitter stock overview from a few months back, I laid out a simple thesis: Twitter is priced for its ad system performance and the very slow growth it showed in recent years. But Twitter is posed to gain velocity with its ad system performance improvements and utilize new monetization schemes.

Since then, we had two major events by Twitter itself:

- Analyst day, with 4 hours of presentation about the company plans and recent operations.

- Q1 results and earnings call We also had multiple product launches, and feature announcements in various PRs, and a Twitter space session hosted by Elliot Turner. I participated in that session, and we had Ned Segal - Twitter CFO - joining in and answering our questions about the company.

In this update, I'll go through everything new to see whether Twitter is on the right track or not. Spoiler alert: I think it is. That's why I added to my position on Twitter after the recent drop.

Loaded some more $TWTR.

— Snir David (long term investing) (@snird) April 30, 2021

Thanks market for the 13.5% discount today! 🙏

Ad system improvements

I want to start and highlight the discussion around the ad system as it's pivotal for Twitter transformation. Ads on Twitter suck. They sucked bad for a long time that most brands don't bother with it.

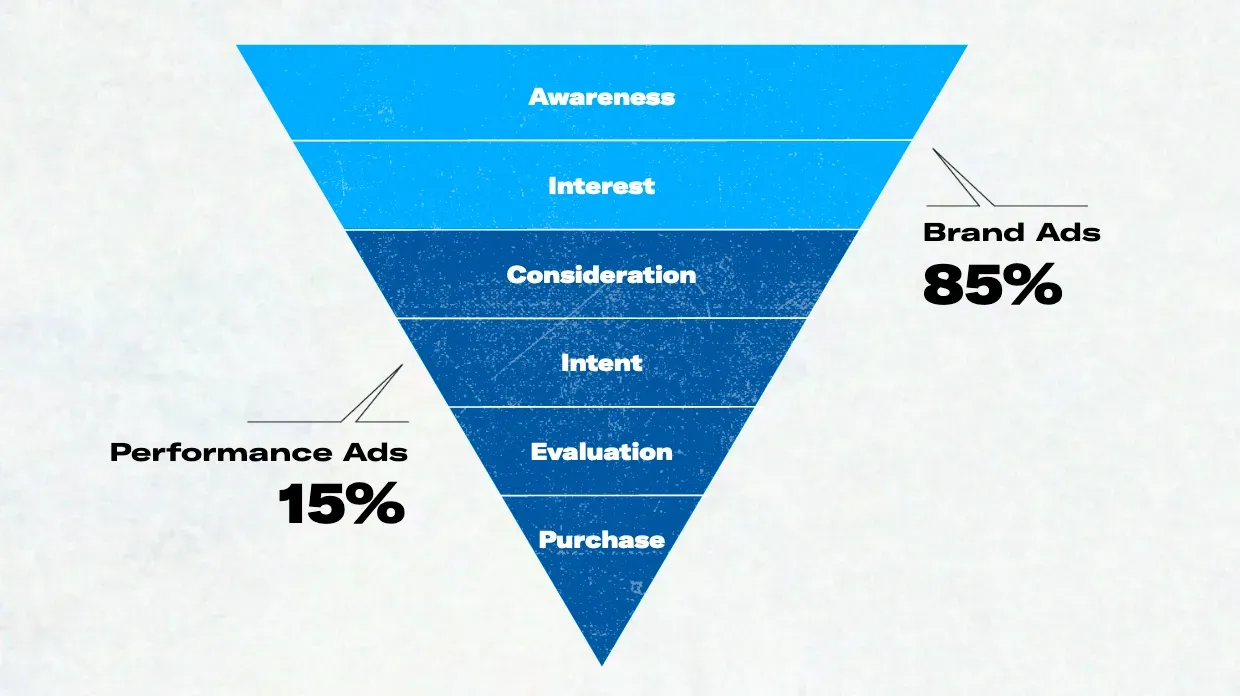

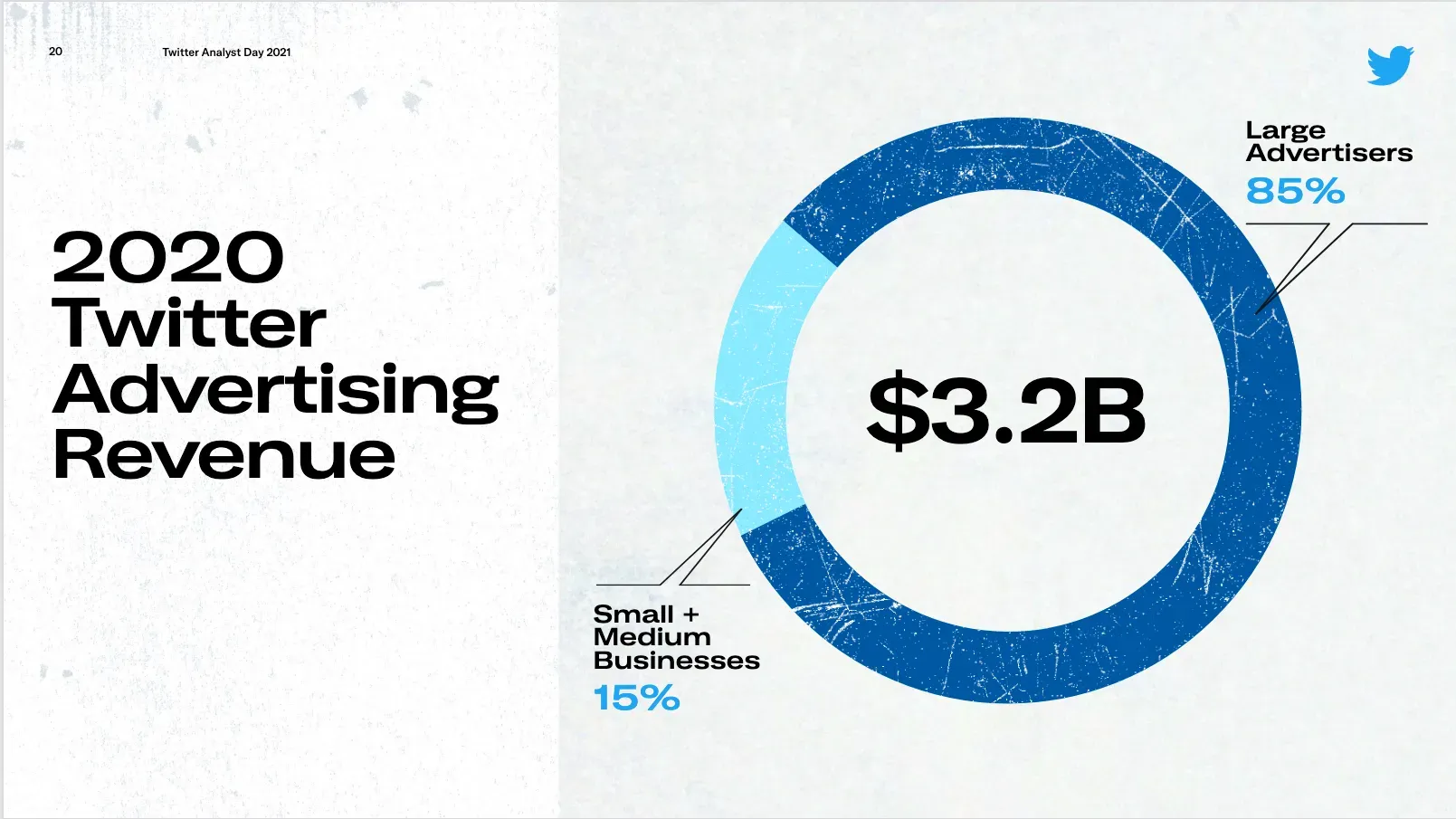

As a result, most advertisers on Twitter were big brands spending for brand recognition, not hoping for measurable actions by the users.

This removed every performance-based campaign from Twitter and prevented small businesses from participating.

Now Twitter is changing all that by focusing on performance ads through new ad features (such as MAP), enhanced analytics presented to the advertiser, and features like Click ID.

The goal stated is to get to a 50-50 division instead of the current 85-15 by 2023. Let's dive into the specifics of what has been done already.

Growing small and medium businesses segments

Twitter wants to address the small and medium businesses in its platform - those neglected to use it due to lack of analytics, problematic and underperforming ad server, and a confusing front-facing system that required highly skilled professionals to use (the largest advertisers in Twitter are historically partners, using Twitter own professionals for setting up ads).

All those points are worked on with results to show already:

- New ad server deployed. Better performance and more flexibility - I will write further about it in the next segment.

- New advertisers site launched - providing better analytics and better UI that enables non-professionals to better work with it.

- Better analytics are driven in part though Click ID feature (But there's more)

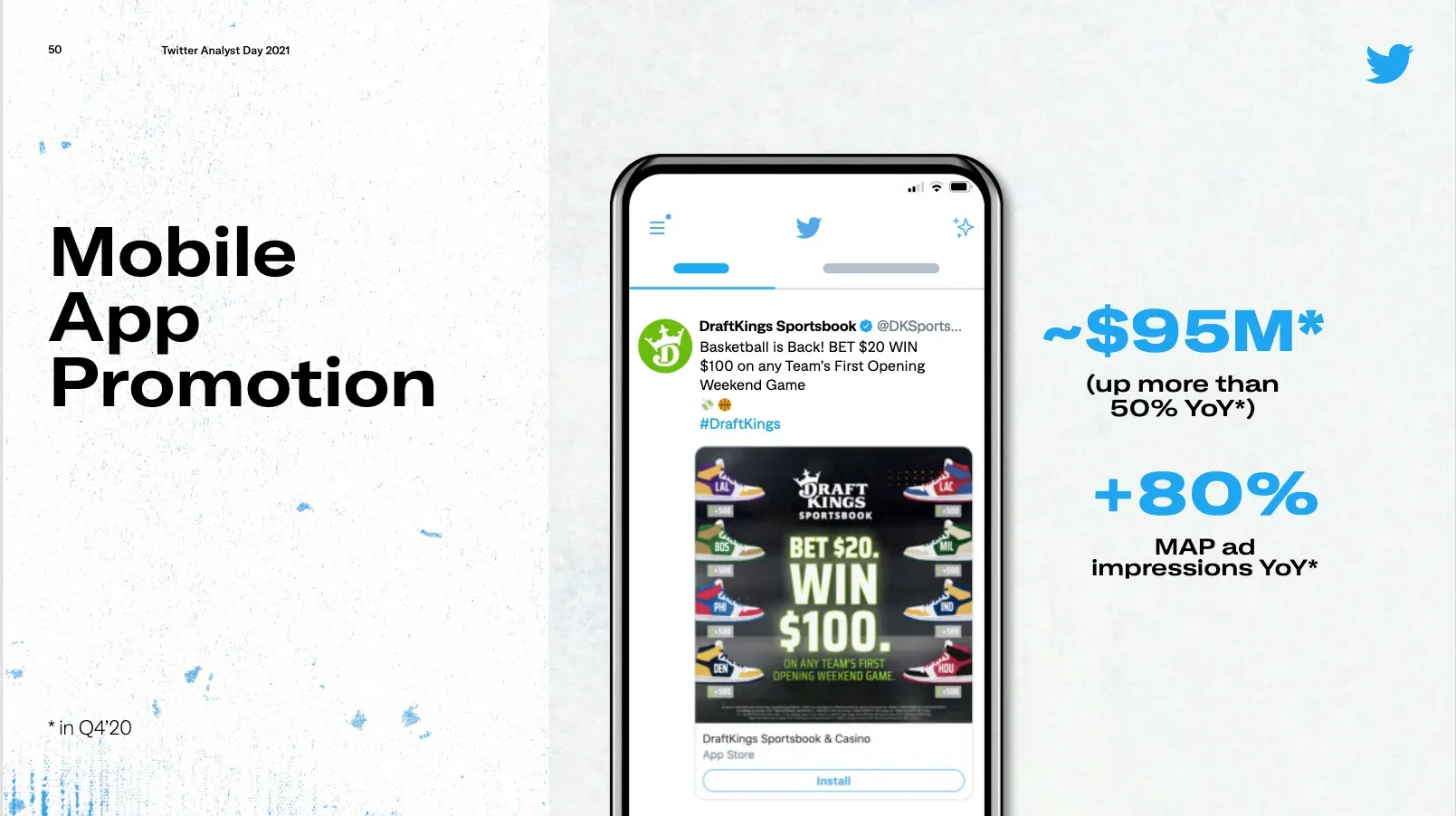

- Mobile App Promotions (MAP) feature allows for direct app ad integrated with the mobile system stores and tracking (for performance)

Better personalization

Improvements in the machine-learning models (enabled through the move to Goggle cloud, but more on that in the "development velocity" segment) already allow for substantial advances in ad personalization.

Twitter measures that through ad engagement and surveys to users. Their results show 20% improvement. Even with a margin of error, that is an impressive improvement for the initial steps taken.

Mobile App Promotions (MAP)

Initially launched in 2014, MAP allows advertisers to have deep integration with the mobile device app store to drive users to install apps and measure the installs to fine-tune the ad.

But the feature wasn't maintained and was lost in the tech-debt twitter accumulated, rendering it almost unusable.

Fixing it now is almost like freshly launching the feature, and the improved results from these kinds of ads speak loudly for it.

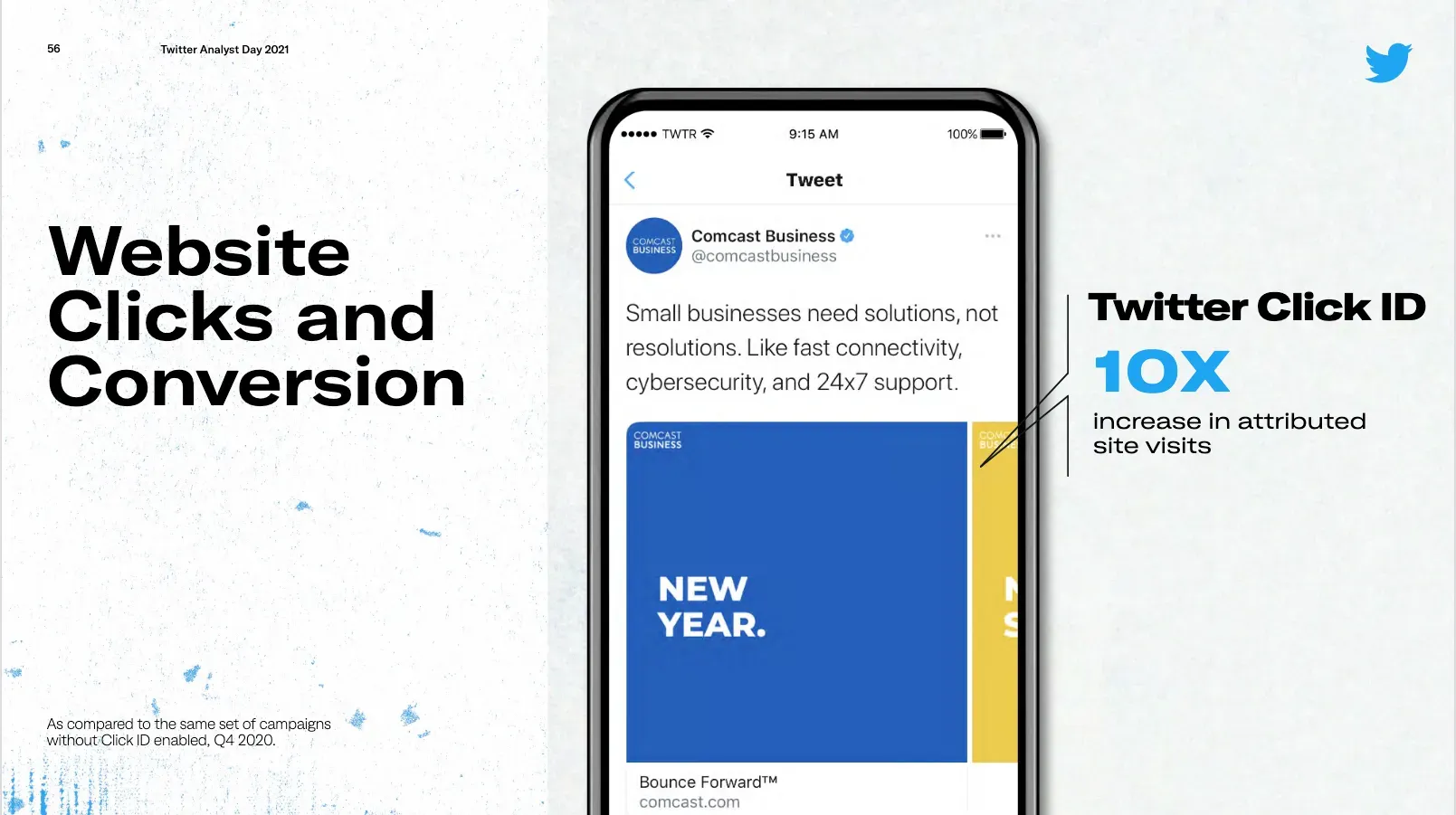

Ad attribution

Another problem mentioned for the Twitter ad system is that its analytics are subpar to the industry standard. They were unreliable, complicated, and often missed most of the data.

Twitter is moving fast to fix it. Trying the new system myself, I can say they have already gone a long way. They are not Facebook, but they are not 2019 Twitter either.

One reason for that is the launch of Twitter Click ID - a new ID measurement to track which user clicked/saw which ad. This tracker then allows the customer to attribute a sale or a later visit to their site to the campaign they ran on Twitter.

Development velocity

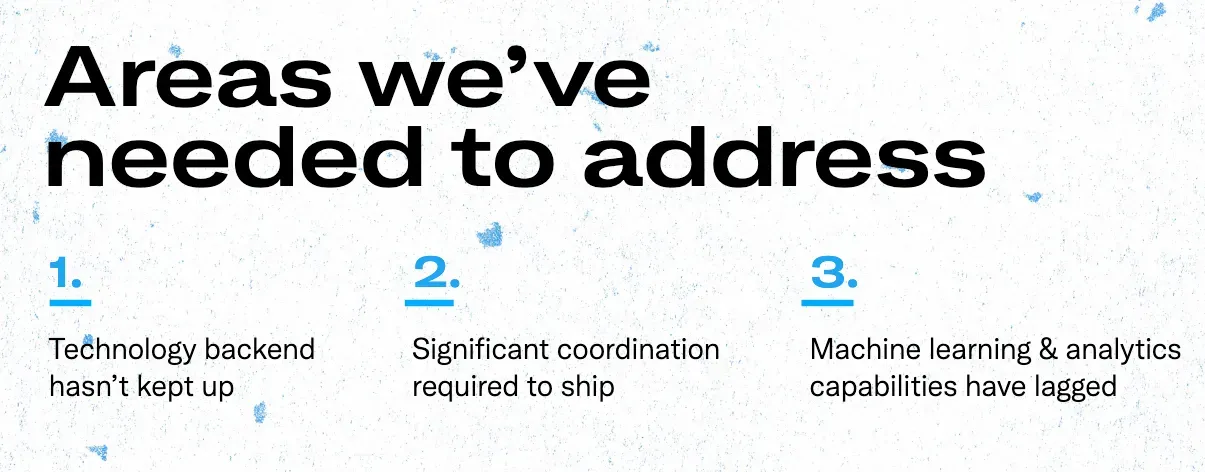

It seems like Twitter hasn't made significant changes to the product for years. And Jack Dorsey himself admitted as such in the Analyst day and the Q1 earnings call.

The reason was a huge tech debt accumulated for years that the tech team had to "pay" and move forward from all while having a massive scaled system running in real-time.

Backend upgrades

Twitter had two massive issues in their backend engineering:

- They developed in-house tooling for common problems that quickly got behind the industry standard and couldn't integrate with any new technology

- The 3rd party tech they did use was chosen before a market leader emerges, leaving them with out-of-favor tech (Mesos selected vs. Kubernetes)

The solution was a slow and lengthy process of redoing most of the backend for Twitter, moving into standard open-source solutions that will enable faster iterations on the product without the old tech getting in the way.

I'll name 3 crucial examples:

- Moving from Mesos to Kubernetes enabled cloud orchestration with standard tooling that makes it easy for Twitter to move away from their own data centers to a tech-leading cloud provider.

- Moving the queuing system from an in-house grown one to Kafka enabled faster integration with their data source, empowering their machine-learning algorithms to work on stream, closer to real-time, than on batch.

- Moving the build system to Bazel enabled 20% faster builds, empowering the developers to have a much faster feedback loop on their work.

Interdependent systems slowed down delivery

Twitter was built as a complicated monolith app that got to a point where everything was so entangled that any shipment to production required complicated coordination with too many people and teams.

Twitter is solving that by modularizing their systems, making them independent so that every team will be able to iterate on their module without any dependency on any other team.

The rebuilt of the ad-server as a new module is an excellent example of that and the reason we saw so much more improvements to the ad system recently.

The improvement resulted in higher improvements in shipment velocity: in the first half of 2020, only 56 improvements shipped, while more than 100 improvements shipped in the second half of 2020.

Machine learning capabilities lagged

Twitter having its system so complicated made it hard to extract relevant data and apply effective machine-learning models. But recent improvements changed that.

Kayvon (product lead) said that the recent machine-learning improvements are responsible for 3x more mDAU engagement in the last year.

The machine-learning models are responsible for a better, more relevant algorithmic home feed, following recommendations and features like "topics".

The machine-learning improvements made possible by moving the entire operation to the Google platform, taking off the heavy operation load from Twitter engineers that now can focus on the models themselves exclusively.

Innovation

All the improvements stated above are compounding to a significant effect on the innovation and delivery in Twitter.

Previously, every feature took 6-12 months to deliver. Now that happens in weeks.

This is evident with the remarkable work done with Twitter Spaces - it was developed in a remarkable time frame and delivered to a massive scale audience almost flawlessly.

They could deliver this feature to 200 million daily users in a record time and for both iOS and Android platforms. Clubhouse, on the other hand, with over 4x their time and less than 10% of their scale, couldn't deliver an Android app yet.

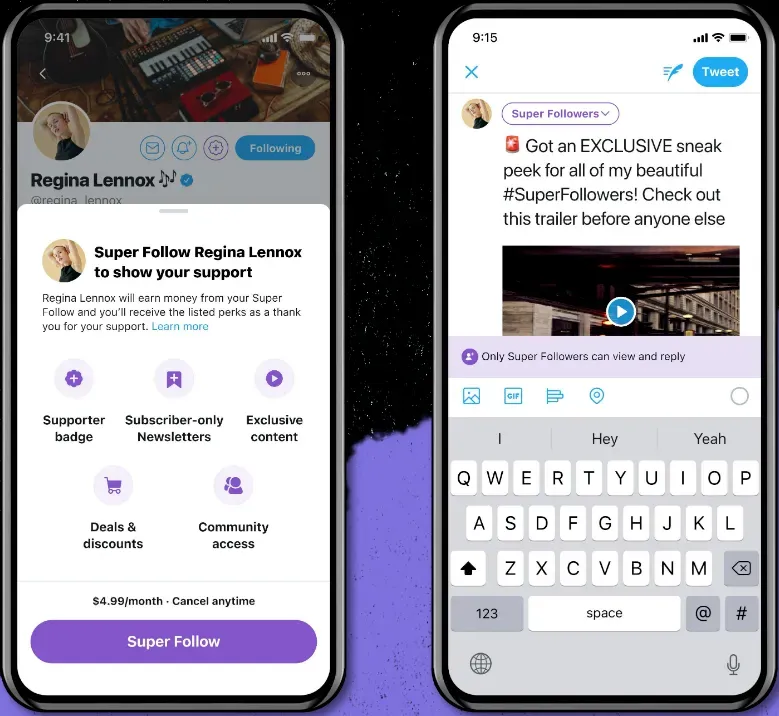

Spaces, Revue & Super-follow

Apart from the ad system becoming more effective and profitable, these new systems are opening up new monetization paths. Twitter monetizing in these ways will generate more revenue and attract more creators to use the platform - enlarging the pie.

Spaces

Spaces are open for everyone since a few days ago. Including Android users, of course (ahm Clubhouse).

The feature works great, and by being on Twitter where people are already connected to people that interest them - it generates discussion opportunities that don't exist anywhere else. A case in point is the Space session I mentioned at the beginning, where we discussed Twitter results and had Ned Segal, Twitter CFO, joining us.

Moreover, Twitter announced that they are working to create a monetization path for Spaces sessions.

we're focused on learning more, making it easier to discover Spaces, and helping everyone enjoy them with an engaged audience. here are some features we're working on:

— Spaces (@TwitterSpaces) May 3, 2021

- Ticketed Spaces

- Co-hosting

- Scheduling

- More block labels + warnings

- Improved captions

Revue, super-follow

Revue is already integrated with Twitter, allowing users to create a newsletter. Monetizing it through the "super-follow" feature is still coming.

We still don't have an estimate, but it's in the working.

What it means

I can't stress enough how these new features and monetization paths are critical for my hopes for Twitter.

These features will create a one-stop-shop for creators that want to leverage the platform completely:

- Tweet an idea in a short form

- Discuss it in a live session on Spaces

- Write about it in long-form in Revue.

And in every step of the way, you'll be able to monetize your crowd for high-quality content.

Being able to monetize on Twitter will drive in even more creators - suddenly, it's not only a platform to get discovered on and move your customers elsewhere. Now it's a platform for creators to meet their potential customers and monetize them friction-free.

Goals for 2023

Whenever the executives talked about long-term plans throughout Analyst Day, they mentioned measurable goals to reach by 2023.

Product & Internal goals

- Reaching 315M mDAU

- Double development velocity

- Average 20% annual user growth

- 50% of ads will be performance ads (compared with 15% today)

Financial goals

- Double revenues from $3.7B to $7.5B

- Total costs and expenses are expected to grow 25%, but revenues should grow faster

- 40%-45% EBITDA margins long-term

Share buybacks

Already announced before, the share buyback plan of buying $2B worth of shares is moving on.

Ned Segal mentioned that the buybacks would be done responsibly, implying it will be halted in cases where the stock price will get too high.

In Q4, Twitter already purchased $250M worth of shares.

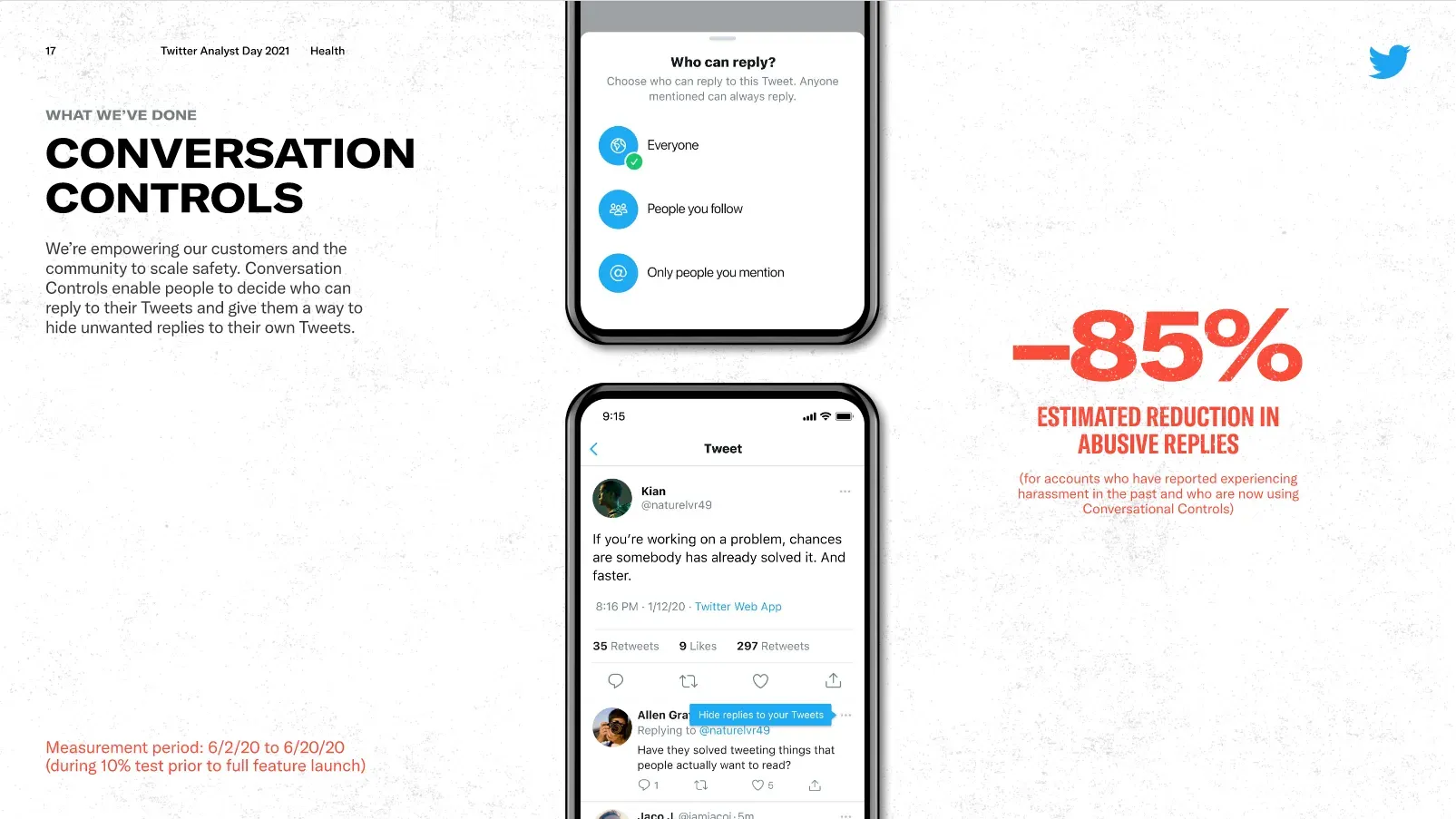

Healthy participation

A considerable chunk of Analyst Day and executives' discussion of Twitter as a whole is dealing with healthy participation.

In other words, Twitter is full of trolls and bigots that make the environment toxic and scare away many good people out of the platform, and Twitter management is aware of that.

I can say that in my personal experience, Twitter is a lot better in that regard already.

And this is not just my experience. Twitter delivered crucial features to improve the situation and already has numbers to back up the claims the Twitter is slowly becoming a better place for everyone.

Taking care of the toxicity of some members of Twitter is essential to build a good, engaged community in the long term. It seems that Twitter is pushing in the right direction with a long-term mindset, as features like the prompt before link share undoubtedly lowers short-term tweets and engagement - but make the community better in the long term.

Improved discoverability

Twitter is a great product to be discovered as a creator.

Creating tweets or tweet-storms is a comparatively low-effort endeavor (than producing 10 min videos every week to be discovered on youtube, for example) with high-potential virality and discoverability on merit alone.

That's why many creators come to Twitter to grow an audience and then direct them to Substack, Gumroad, Teachable, or any other monetizable product. Hopefully, soon enough, the monetization will stay within Twitter.

Having the optionality of being discovered even more quickly is an excellent prospect for the creators' economy built on Twitter.

And not just for the producer's side - as a new user in the platform, making it easier for you to discover the content that interests you will undoubtedly increase engagement and usage of the platform.

On top of an ever-improving "home feed" that I mentioned before, enhanced by better Machine Learning algorithms now - Twitter keeps launching features to improve discoverability.

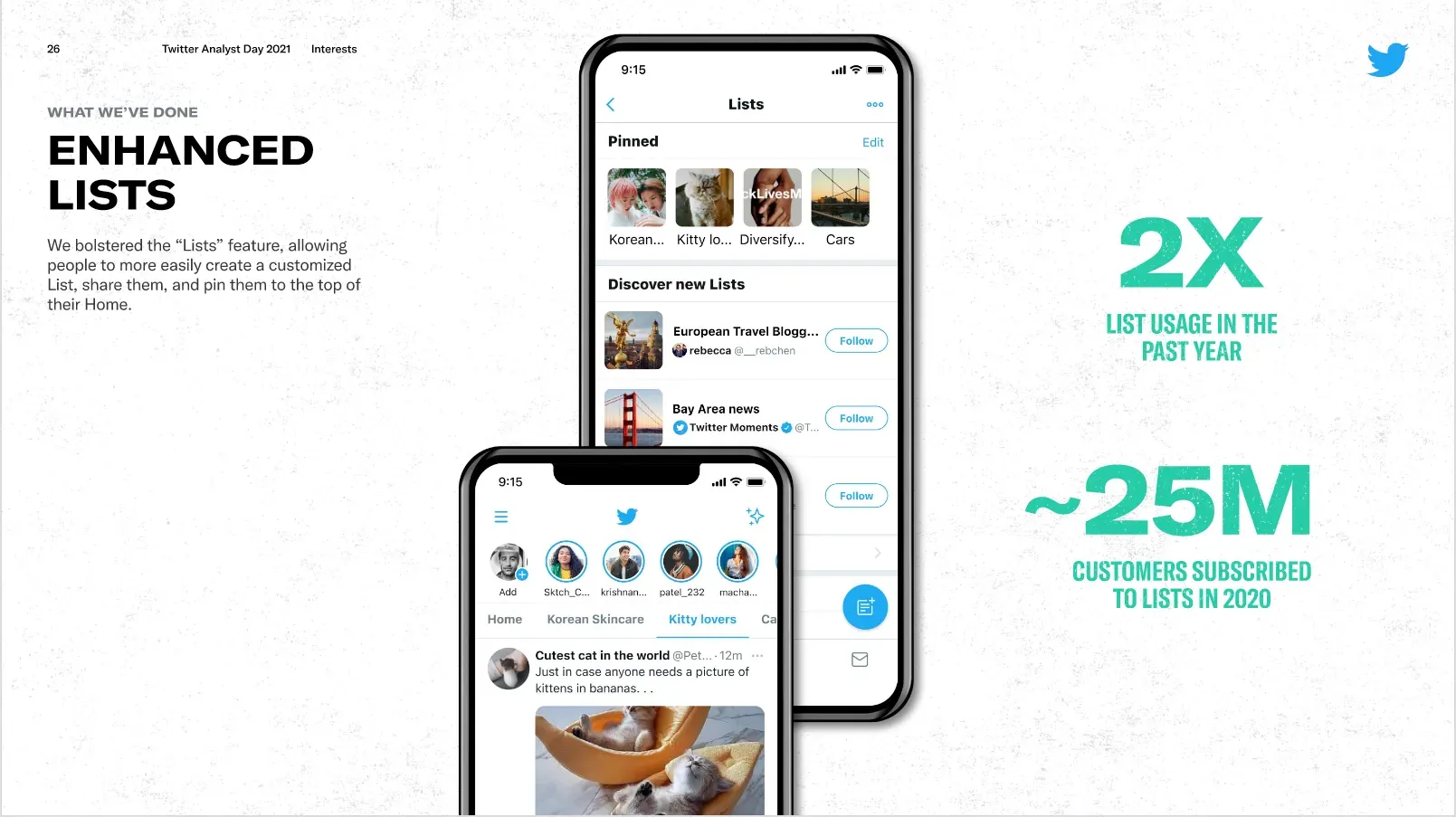

Two important features are the "Enhanced lists" that take the concept of the list a step forward, allow for easier access to them on the home screen. The second feature is an enhancement to the "Topics" suggestions - making far more topics that are even more tailored for the long-tail.

Q1 Results

Twitter results for Q1 were ok. The remarkable growth of revenues in Q4'20 didn't spill over to Q1'21, and it left some investors disappointed. Still, as I mentioned in my original overview of Twitter as an opportunity - the thesis is on long-term improvement of ad systems, new monetization path, and consistent growth of users. Nothing to be done in a quarter, but rather in the next few years.

Revenues

In terms of growth, Twitter showed 13% growth YoY and -20% growth QoQ.

The QoQ decrease is expected and occurs everywhere in the advertisement business, especially brand advertisement that consists of most of Twitter's business.

Nonetheless, the decrease is somewhat more significant than some expected. It means that the revenue growth from the last quarter isn't solidified and might be a one-time blip. In any case, there is growth this year, just not as big as some expected (hence the recent stock dump).

mDAU

mDAU growth of 3.6% this quarter officially remarks the "back to normal" growth, as in the growth before Covid (and even slightly less than before covid).

Again, this figure is disappointing too, on its face, but when we look at the year as a whole, where Twitter grew 27% - it looks better. It's reasonable to have somewhat slower growth after the Covid boom.

I do expect that everything that Twitter is doing that I mentioned throughout this article will drive accelerated growth in the next year.